Highlights

- Market Update: Slogging It Out

- Bright Side of “The Great Reset”

- Behavioral Finance: What’s Your Attention Allocation?

- Firm Update: Welcoming Rachel Rush

Market Update: Slogging It Out

In mid-summer, investors received a brief reprieve from this year’s punishing stock market declines as pundits espoused the idea that the Federal Reserve was close to pausing its interest rate hiking campaign. The relief was short-lived, however, as another white-hot inflation report in early September initiated a new round of tough talk from Fed Chair Jerome Powell that further interest rate increases would be necessary, even if that meant bringing “pain” to everyday Americans in the form of a recession and higher unemployment.

Investors, unaccustomed to such “tough talk” after a decade of Fed stimulation to prop up financial markets, sold off both stocks and bonds to new lows for the year. Below are returns for various asset classes for the quarter ended September 30th, 2022.

| Asset Class | Index | Q3 Return | Year to Date Return as of 9/30/2022 |

| U.S. Large Stocks | S&P 500 | -4.9% | -23.9% |

| U.S. Small Stocks | Russell 2000 | -2.2% | -25.1% |

| International Developed Stocks | MSCI EAFE | -9.3% | -26.8% |

| Emerging Markets | MSCI Emerging Markets | -11.4% | -26.9% |

| Bonds | Barclays Aggregate Bond | -4.8% | -14.6% |

Bright Side of “The Great Reset”

Herbert Stein, an influential economist in the 20th century, once said that “if something cannot go on forever, it will stop.” To paraphrase, “trends that can’t continue won’t.”

We would argue that the unsustainable financial trends that developed in the last decade now appear to be reversing back to more historical levels. This “reversion to the mean” is creating anxiety for Wall Street and Main Street alike, but we think there are long-term benefits to getting back to average.

Below we highlight three trends that bear watching and provide our views of the bright side of each.

Increasing Inflation

“Reports of my demise are greatly exaggerated” – Inflation, circa 2022

After lying dormant for the last 13 years, inflation has roared back from the dead during 2021 and 2022 due to trillions of dollars in economic stimulus associated with Covid response, supply chain bottlenecks, Russian aggression towards Ukraine, and pent-up consumer demand as the economy re-opened from the pandemic. Policy makers, economists, and the Federal Reserve have all been caught off guard by both the magnitude and persistence of price increases in everything from household basics such as food and fuel to discretionary items like airfare and second homes.

The Federal Reserve spent 2021 convincing everyone that inflation was “transitory” and thus there should be no rush to raise interest rates to cool off the economy. Now the Fed is playing catch-up to restore its credibility and its aggressive rate hiking cycle is contributing to significant volatility in a range of global financial markets.

Left unchecked, inflation becomes a self-reinforcing and self-fulling prophecy as consumers and businesses accelerate what would be future purchases in order to avoid anticipated price hikes. These actions wind up driving costs even higher when demand outstrips supply.

While too much inflation has ruined many economies over the centuries, modest annual price increases are healthy for businesses, workers, and homeowners in the form of higher sales, salaries, and home values.

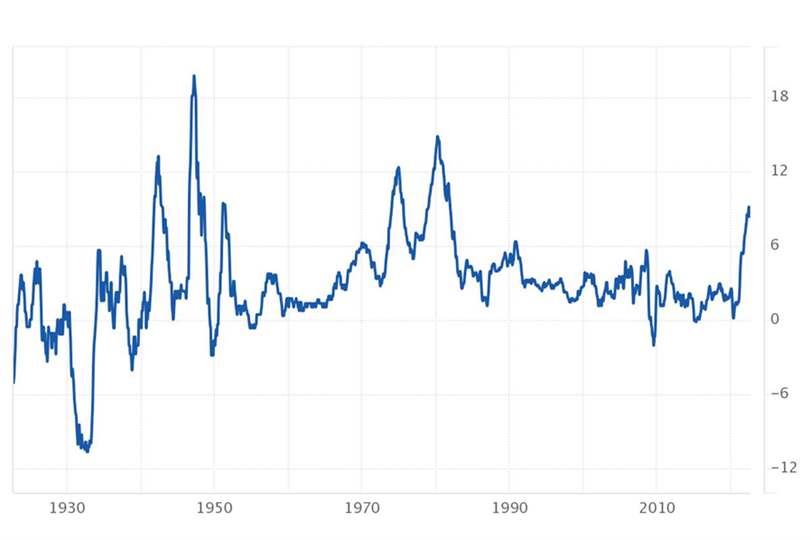

The figures and chart that follow provide context for the current handwringing over inflation. While the present rate of 8.3% is obviously unsustainable, an argument can be made that so was the 1.7% rate from 2010-2020. After all, since 1914, prices have risen by 3.3% annually. Given the powerful force of “mean reversion,” some period of above-average inflation seems necessary to get back to the long-term trend.

Current rate: 8.3%

2010-2020: 1.7%

Long-term average 3.3% (since 1914)

Historical Inflation Rate (1914-Present)

Source: Trading Economics.com

Increasing Interest Rates

A year ago, potential homebuyers could count on sub 3% mortgage rates to increase their purchasing power. Buyers were so flush with cash and optimism that they were willing to waive inspections, buy vacation homes sight unseen, and engage in bidding wars that shot the final price well above asking. Savers, on the other hand, continued to suffer under the “There Is No Alternative” (TINA) to stocks regime, given that bank savings accounts were paying 0.01%. These dynamics reversed rapidly throughout 2022 as the Fed raised interest rates, such that currently, mortgage rates were nearing 7% and money market funds were yielding close to 3%.

Again, we should spend time thinking about the benefits of higher interest rates. Beyond the obvious windfall that will inure to savers in lower-risk investments such as CDs and money market funds, which can now offer yields of 2% to 3%, higher borrowing costs will mitigate the rapid rise in asset value inflation that can lead to a bubble that inevitably bursts at a future point in time. We also think higher interest rates will attract investors to companies with lower debt levels, a hallmark of the firms our portfolio managers favor.

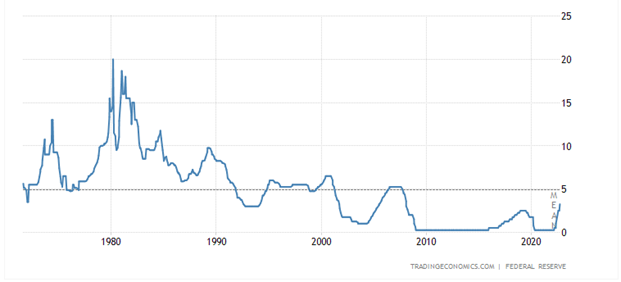

As can be seen from the figures and graph that follow, interest rates continue to be well below historical averages.

Current rate: 2.5%

2010-2020: 0.7%

Long-term average 5.4% (since 1971)

Historical Interest Rates (1971-Present)

Moderating Stock Market Returns

The final trend we’re keeping a close eye on is, of course, the current bear market in stocks. As of this writing, the U.S. stock market has fallen nearly 21% for the year, putting it below the 20% decline threshold that defines a bear market. While no one likes to see the value of their portfolio decline, we think this year’s sell-off is a natural and normal response to unsettling geopolitical news and the paradigm shift the Federal Reserve has undergone from being a tailwind to stock prices to being a headwind.

Like the other trends we’ve reviewed, however, there are some positive aspects to stock declines. For one, dampened enthusiasm for equities helps keep a lid on rampant speculation, which hopefully lessens the risk of a bigger market meltdown in the future. Second, lower portfolio values can aid in the battle against inflation since investors have less capacity to borrow against their holdings to buy real estate and other big-ticket items.

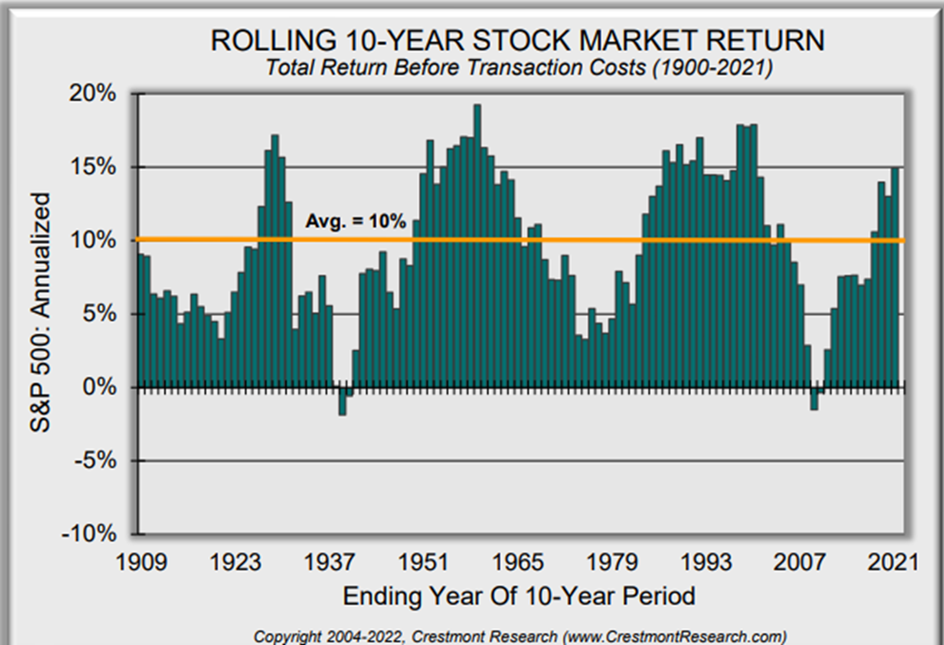

As the figures and chart below illustrate, the long-term average gain on stocks is 10% per year. The last decade, however, has seen annualized gains of near 14%, which is a good indicator that we could be in for some lean times to come if we expect returns to fall back to average levels.

2022: -24%

2011-2020: +13.9%

Long-term average +10% (since 1900)

While we certainly can’t predict the stock market’s future direction, we are not reflexively resigning ourselves to expecting negative returns for the foreseeable future.

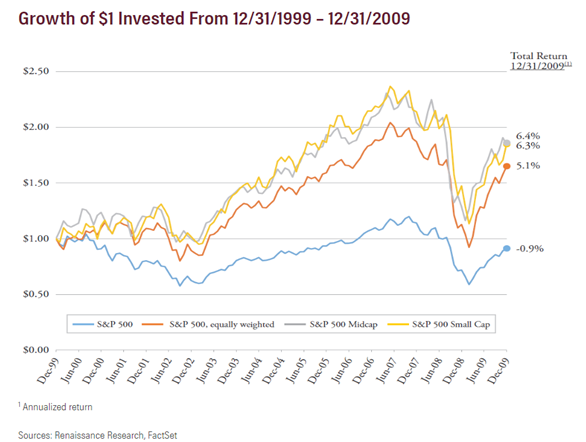

Long-tenured clients will recall “The Lost Decade” of 2000-2009 when U.S. stocks, as measured by the S&P 500 index, delivered an annualized LOSS of -0.9% for the 10-year period. Peering under the hood of the market during that time, however, one sees that investors with a diversified portfolio actually made out quite well. As the graph that follows illustrates, investors who owned mid-size and small U.S. stocks earned returns north of 6% annually. Even investors in large U.S. stocks saw gains over 5% per annum if they invested beyond the top names in the market-cap-weighted index. Not shown on the graph but certainly noteworthy is that international emerging market stocks delivered eye-popping gains of 14% per year over the same period.

This dispersion of returns among various equity asset classes reminds us of the importance of maintaining a diversified portfolio and avoiding the group-think mentality that defines index fund investing. With the constant barrage of negative headlines these days (recession, inflation, war, etc.), it’s only natural to feel pessimistic about future portfolio returns. We think, however, that investors who pair a healthy dose of patience with restrained exposure to the 24/7 media cycle have good reason to be optimistic about going forward.

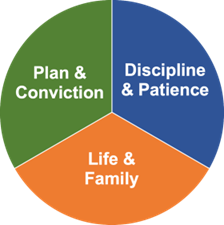

Behavioral Finance: What’s Your Attention Allocation?

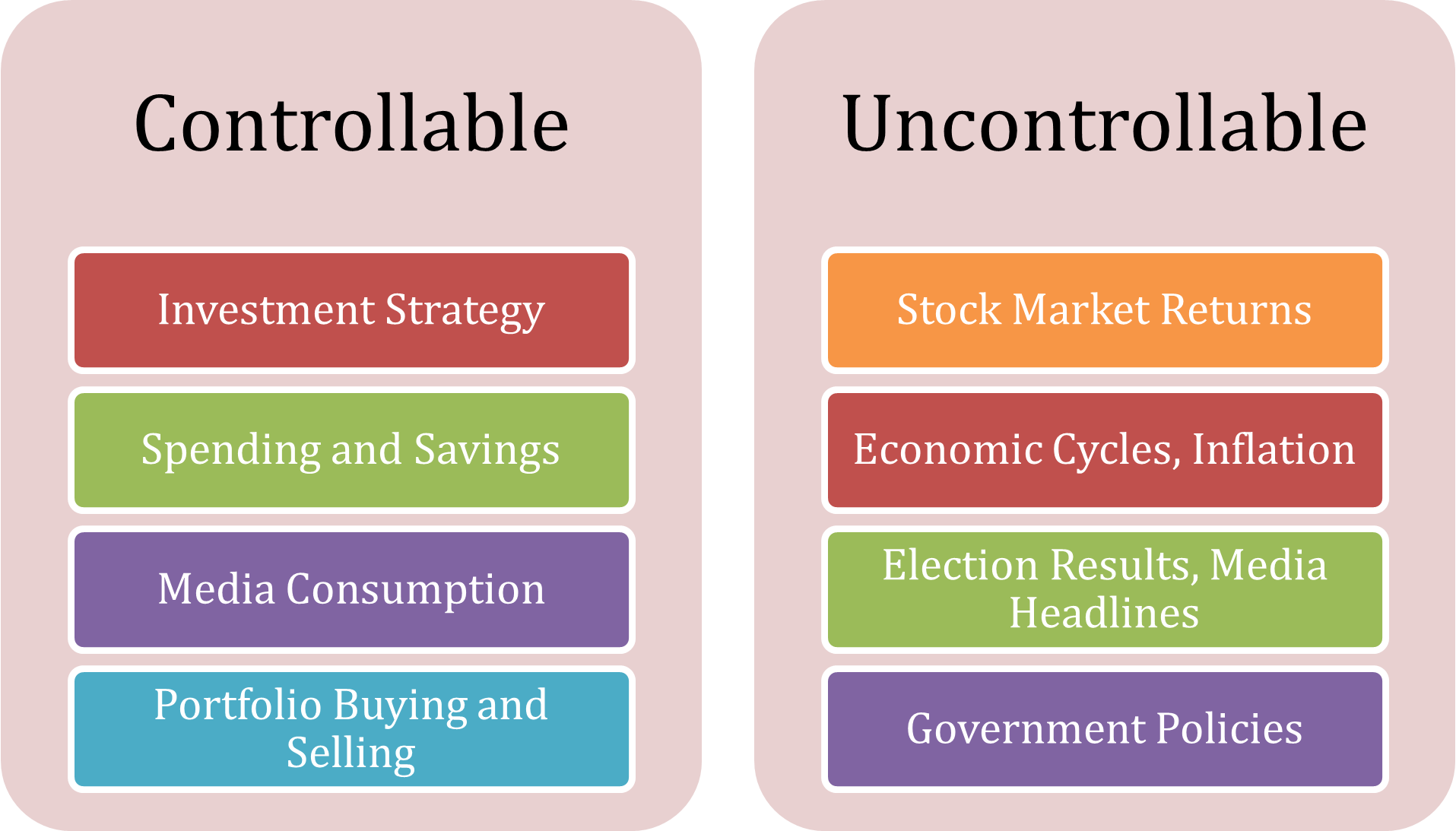

As financial advisors, we spend significant time understanding your risk tolerance and goals when recommending an asset allocation for your portfolio. We think an equal amount of time should be spent discussing how clients spend their time and energy monitoring the financial media, daily stock market movements, and “expert” forecasts. Our experience suggests that those who pay less attention to the daily noise of the markets and fluctuations of their portfolio values will experience less stress and have a higher probability of reaching their financial goals. So the next time someone at a cocktail party asks about your asset allocation or if you are worried about a recession, perhaps you can also educate them on your “attention allocation.”

We close the behavioral finance portion of this letter with what we think is the most timeless advice we can offer in turbulent times: focus more of your time and energy on what you can control about your financial plan and less on those parts that are uncontrollable.

Firm Update: Welcoming Rachel Rush

We are pleased to introduce our newest team member, Rachel Rush, who joined us in August as a Client Service Associate. Rachel is a graduate of Iowa State University and has a background in financial services. We know her positive personality and client service mindset will benefit our firm and clients.

Who Can We Help?

For more than 29 years, we have helped guide individuals and families to their financial goals. As a result, our business now comes to us primarily through referrals. If you know a friend, colleague, or family member who could benefit from one of our many services, we hope you’ll invite them to visit our website to learn more about us and schedule a complimentary consultation.

Our services:

- Retirement Readiness

- Investment Allocation

- Paying for College

- Social Security Planning

- Retirement Community Consultations

- Philanthropic and Family Legacy Planning

Please remember to contact us if there are any changes in your personal financial situation or investment objectives so that we may review your long-term investment strategy. As always, we welcome your phone calls and emails should you have any questions or would like any further information.

We appreciate the opportunity to serve you and are grateful for the trust you place in us as stewards of your financial resources.

Very truly yours,

Mark A. Kuhn & Scott W. Ranby