Highlights

- Market Update: Relief Rally

- Lessons from 2022

- SECURE Act 2.0: Those Turning Age 72 Take Note!

- Behavioral Finance: The Only Forecast that Matters

- Firm Updates: Office Move and 30th Anniversary Celebration

Market Update: Relief Rally

After dipping to new lows in the early fall, major asset classes rallied during the final three months of the year as inflation cooled ever so slightly. Investors cheered signs that the Federal Reserve’s aggressive interest rate hikes over the course of 2022 may finally be having their desired effect of slowing price increases. Despite a glimmer of hope that inflation has peaked, the Fed maintained its tough rhetoric and pledged to raise rates into spring 2023 primarily because of strength in the labor market.

Below are returns for various asset classes for the quarter and year ended December 31st, 2022.

| Asset Class | Index | Q4 Return | 2022 Return |

| U.S. Large Stocks | S&P 500 | +7.6% | -18.1% |

| U.S. Small Stocks | Russell 2000 | +6.2% | -20.4% |

| International Developed Stocks | MSCI EAFE | +17.4% | -14.0% |

| Emerging Markets | MSCI Emerging Markets | +9.8% | -19.7% |

| Bonds | Barclays Aggregate Bond | +1.9% | -13.0% |

Lessons from 2022

While investors are no doubt ready to turn the page on a miserable 2022, we think it worthwhile to spend a few moments reflecting on lessons that can be gleaned from the forgettable performance of most financial markets.

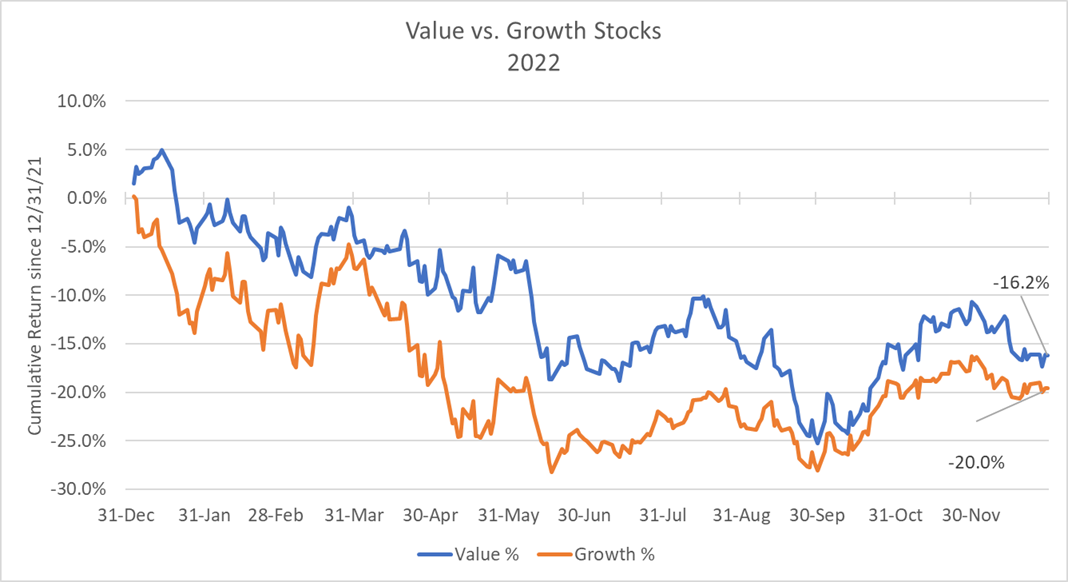

Value Stocks Return to Favor

As the Federal Reserve raised interest rates throughout 2022 to combat unsustainably high inflation, investors grew increasingly concerned that the Fed’s uncompromising actions would induce a recession. Rising interest rates also caused stock pickers to re-assess the earnings potential, valuations, and debt-levels of their holdings. As is often the case when the outlook for stocks grows cloudy, investors began shying away from growth stocks and sought shelter in value shares. The chart below illustrates how value stocks held up better through the year, declining 16.2% vs. a 20% decline for their growth stock peers.

As a reminder, we construct our client portfolios by partnering with money managers who embrace the core tenet of the value investment style: buying shares in what they think are quality companies at a discount to their intrinsic value.

Source: Yahoo! Finance. Value stocks represented by VLUE, Growth stocks by MTUM.

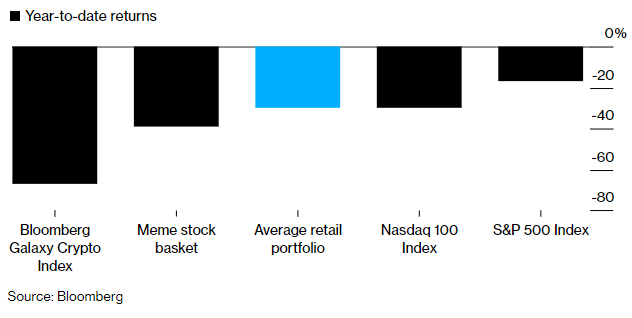

Buying What’s Popular is Risky

Warren Buffett once quipped that, “only when the tide goes out do you discover who’s been swimming naked.” Due to a sea change in economic and monetary conditions throughout last year, plenty of investors were caught bathing in their birthday suits, and the picture was not pretty.

As seen in the chart below, many of 2021’s most popular investments struggled mightily last year, fueled by the economic stimulus burning a hole in the collective American pocketbook and a new generation of YouTube influencers promoting “can’t miss” investments. These questionable assets, including meme stocks, crypto currencies, and nearly bankrupt companies like AMC, Bed Bath & Beyond, and others soared in 2021 only to shed anywhere from 30% to 60% a year later. In fact, the average retail investor’s portfolio fell 30% in 2022.

https://www.bloomberg.com/news/articles/2022-12-09/retail-traders-lose-350-billion-in-brutal-year-for-taking-risks?srnd=premium&sref=K9UESTXD. Year-to-date returns as of 12/9/2022.

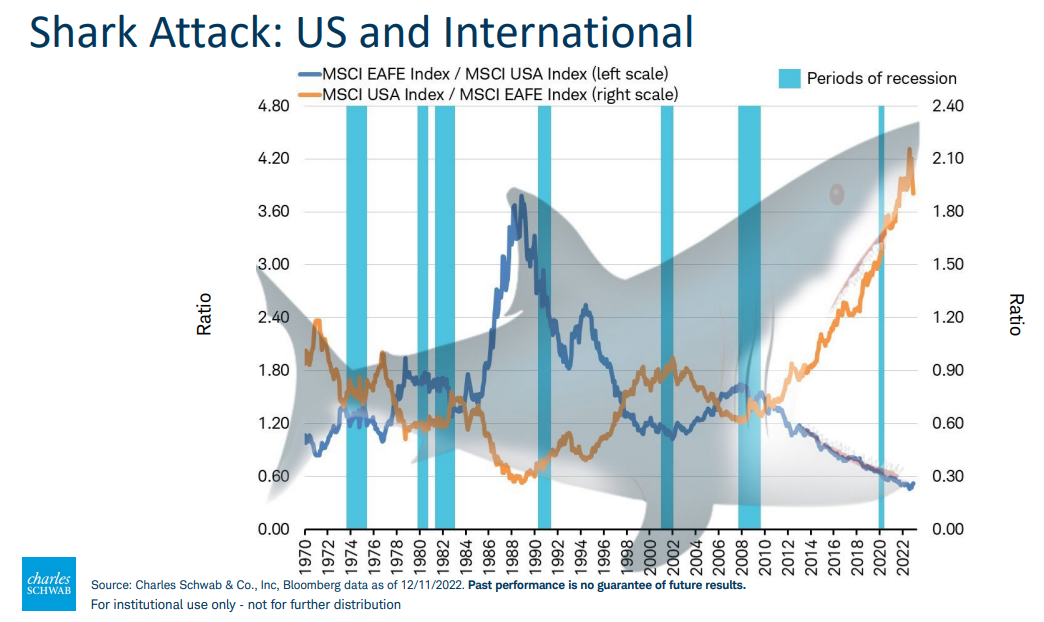

Trends that Can’t Last Forever Won’t

As we discussed in our previous letter, the past 15 years have been characterized by rock-bottom interest rates, low inflation, and above-average stock market returns.

All these trends showed signs of reversing in 2022. We think these trends provide opportunities for our investment managers in the years ahead.

Another trend that had grown long in the tooth is the outperformance of U.S. stocks relative to foreign shares. As the graphic below illustrates, U.S. and international stocks have gone through numerous cycles of outperformance relative to one another for the past 50 years. However, as the orange line indicates, U.S. stocks have held the upper hand since 2010. The blue shaded areas of the graph indicate U.S. recessions, which historically have served as inflection points for a change in leadership of U.S. (orange line) and international (blue line) stocks. With recession risks again mounting because of the Fed’s aggressive interest rate campaign and given the attractive pricing of global shares versus U.S stocks., we will closely follow this dynamic.

While there is no guarantee that international stocks will bounce back to outperform their domestic peers, 2022 was an encouraging sign as the MSCI EAFE index (a popular benchmark of foreign stocks) did outperform the S&P 500, albeit by losing less than the well-known domestic index. Regardless of the year-to-year winner in the U.S. vs. global stocks competition, we continue to think that diversified portfolios lead to better outcomes, and thus we think it’s appropriate to allocate a meaningful portion of client portfolios to international stocks. For context, the U.S. provides approximately 4,000 publicly traded companies[1] in which our fund managers can choose to invest; this is a fraction of the roughly 58,000 exchange-listed companies[2] worldwide. A greater number of choices provides access to more investment opportunities.

[1] https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/reports-of-corporates-demise-have-been-greatly-exaggerated

[2] https://focus.world-exchanges.org/articles/number-listed-companies

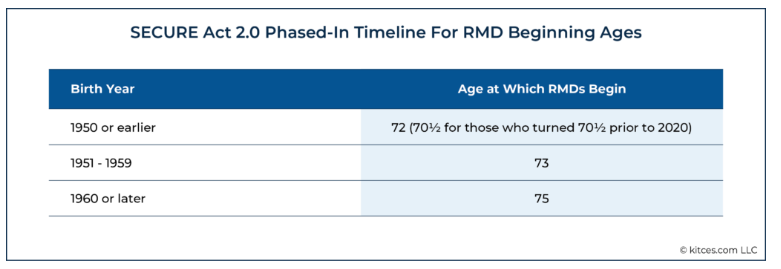

SECURE Act 2.0: Those Turning Age 72 Take Note!

As 2022 ended, new legislation was passed by Congress and signed into law by President Biden that may impact your financial plan. Here are the highlights from the SECURE Act 2.0 bill:

- Postpones Required Minimum Distributions to Age 73

- Individuals who turn age 72 in 2023 will not be required to begin minimum distributions from IRA and retirement accounts until 2024 when they turn age 73.

- Beginning in 2033, the RMD age is pushed ahead to 75.

- Any individuals required to take RMDs in 2022 will continue to need to do so. See below table for a helpful summary:

- 529 to Roth IRA Transfer

- Beginning in 2024, up to $35,000 of 529 plan funds not needed for college can be transferred to a Roth IRA. This ability is subject to numerous conditions, which we will explore individually with you.

- New Maximum for Qualified Charitable Distributions (QCDs)

- Beginning in 2024, the maximum annual QCD amount (currently $100,000), will be indexed for inflation.

Behavioral Finance: The Only Forecast that Matters

For this quarter’s behavioral finance lesson, we borrow from our esteemed colleague Jay Mooreland at The Behavioral Finance Network, who reminds us:

Most investors love economic and market forecasts. With the markets so uncertain and volatile, our brain craves some sort of idea of what the future holds. But the markets are unpredictable – evidenced by the fact that no one can consistently predict them with accuracy. Of course, a certain forecast will be right from time to time, just like a broken clock. But market forecasts are not reliable, no matter what your brain tells you.

Unlike market and economic forecasts, my forecast is reliable and robust because it is based on enduring investment truths and investor behavior. These factors are more dependable than market outcomes and more important to an investor’s well-being.[1]

Our Forecast For 2023

In full disclosure, the following forecast is nearly identical to our forecast from last year and years prior.

- The economy/market will mostly likely do something that surprises us (and the experts). In hindsight, we will wonder how we didn’t see it.

- The financial media will sensationalize headlines and short-term market moves to entice you to tune in – so they can achieve better ratings.

- Investors who watch the news and stock market path often will experience more stress than those who don’t.

- Investors who move to cash, waiting for a “better time,” will most likely suffer significant uncertainty and anxiety about when and how to get back into the market.

- Your investment decisions and reactions to market events will have a significant impact on your personal investment return.

- You will be tempted to change your investment strategy based on market performance, expert forecasts, and/or your personal beliefs about the future.

Conviction, patience, and discipline are virtues every investor should develop. They aren’t easy, yet they are essential for your success. As your advisor, one of our most important roles is helping you ignore the noise and focus on what really matters to your financial success.

[1] ©2023 The Behavioral Finance Network

Firm Update: Office Move and 30th Anniversary Celebration

As of February 1, 2023, we are expanding our business with a new larger office location. Our new quarters will be 2828 Pickett Road, Suite 170, Durham, NC 27705, which is in the former Herald-Sun Building. The entrance to our new office will be in the back of the building, so please drive around the right side of the building (entrance is on “Western Bypass”), and we’ll be located on the back corner. Please update your records with our new address to be effective February 1st. Our phone number and email addresses will remain the same.

Save the Date April 27th for our Wealth Conference and 30th Anniversary Celebration

We are pleased to announce the return of our annual Wealth Conference, to be held April 27th in Durham. This year holds special significance as we also celebrate our firm’s 30th anniversary of serving clients. We have lined up two fantastic speakers in the morning and a social gathering in the evening. Stay tuned for an upcoming email with more details.

Who Can We Help?

For more than 29 years, we have helped guide individuals and families to their financial goals. As a result, our business now comes to us primarily through referrals. If you know a friend, colleague, or family member who could benefit from one of our many services, we hope you’ll invite them to visit our website to learn more about us and schedule a complimentary consultation.

Our services:

- Retirement Readiness

- Investment Allocation

- Paying for College

- Social Security Planning

- Retirement Community Consultations

- Philanthropic and Family Legacy Planning

Please remember to contact us if there are any changes in your personal financial situation or investment objectives so that we may review your long-term investment strategy. As always, we welcome your phone calls and emails should you have any questions or would like any further information.

We appreciate the opportunity to serve you and are grateful for the trust you place in us as stewards of your financial resources.

Very truly yours,

Mark A. Kuhn & Scott W. Ranby