Highlights

- Market Update: Reflect on Our Perspective

- Bear Market History Lessons

- Behavioral Finance: Temptations We Face

- Firm Update: Welcoming Hunter Outen

Market Update: Reflect on Our Perspective

As the financial media has reported in bold, screaming headlines, the first half of 2022 was the worst start for the stock market in over 50 years and the worst performance for bonds ever. We are currently in a bear market, but we don’t think this is something to be feared, but rather understood from a historical and rational perspective. Below we share three important points that we hope will help us all maintain proper perspective during such turbulent times:

- The history of financial markets is continuously being written. Performance descriptors such as “worst ever” and “best ever” will continue to emerge and the media will emphasize each new high and low in its all-too-frequent reporting. We accept that enduring the markets’ gyrations is the price that patient investors pay to achieve robust long-term returns.

- While bear markets create discomfort and can instill fear, they are an essential element of healthy capital markets. These periods of contraction squeeze out excess speculation, encourage companies to become more efficient, and set the stage for the next bull market.

- We can neither influence nor predict market path, but how we respond to market movement is in our locus of control. Some investors rush to sell holdings that have experienced steep declines, thus locking in losses permanently. During times like this, we think it important to reflect on one’s personal investment strategy. What is our long-term goal? What do we need from our investment portfolio over the long run and how have we set about achieving that goal? Perhaps pay less attention to the hyperbole coming through the news cycle and give markets and the economy time to sort things out.

Inflation and Recession

- We are in a period of high inflation that may likely persist for a while. With the Federal Reserve increasing interest rates and tightening money supply, there is a decent chance that many global economies will go into a recession. The entire world needs for inflation to be brought to a more reasonable level. If high levels of inflation persist, everyone suffers a progressive loss of purchasing power as the cost of goods and services continues increasing at a rate that exceeds growth in individual income. Recall that our Federal Reserve and many other central banks have kept short-term interest rates exceedingly low for 13+ years. This was an intentional effort to stimulate economic activity as we went through a very deep recession. Once the economy had stabilized following recovery from the recession, the pandemic emerged and we saw several sectors of our economy virtually shut down during efforts to contain the spread of disease, particularly before there was a vaccine. Post-vaccine, we see people playing catch-up to restore normalcy in their lives and the associated surge of spending has contributed to price escalations. The Federal Reserve is playing catch-up here and this is evident from the rate and pace of interest rate hikes being implemented. Each successive one is likely to rattle the markets.

- A recession is often the cure for the disease of inflation. A recession is preferable to sustained inflation, which affects everyone. One of the most severe aspects of a recession, rising unemployment, would likely occur only in particular sectors of the economy. For example, rising interest rates have already affected the pricing of mortgage loans, which will begin to impact the housing sector as higher interest rates will translate into higher monthly mortgage payments. We might therefore expect to see housing-related spending fall, which would impact housing-related industries.

- Past recessions have generally been associated with a significant increase in unemployment. However, our current unemployment rate is quite low at 3.6%, and many businesses are still struggling to fill open positions. While unemployment may rise as the Fed continues to pump the brakes on economic activity, it is uncertain how much of a factor this will have on the overall economy and financial markets. The history of markets and economies continues to be written. It is important to note that our Federal Reserve has never before adhered to a highly stimulative monetary policy for as many years as we have just experienced, so we are still learning what the implications are from having adopted it. To put that in perspective, the most recent Federal Reserve chairs (Bernanke, Yellen, Powell) were students of the Great Depression and were seeking to avoid the great social and economic distress that America experienced in the 1930s – numerous bank failures, high unemployment, and soup lines being some notable characteristics. These Fed chairs did succeed in protecting us from such calamity and their efforts and that success should be recognized and appreciated.

What Can We Do? Anticipate, Learn, and Focus

- Anticipating what we may experience and how we may feel can help us as investors make better decisions. For example, we should expect the media to promote every piece of negative news they can – fear sells by capturing attention. In response, we may grow concerned and perhaps experience some heightened fear about our future. Focusing excessively on fluctuating account values is likely to perpetuate and escalate our fear response, ultimately tempting us to take actions that might later prove to be unwise.

- We can temper our emotional responses to negative news and portfolio performance by reflecting on past market downturns. Let’s think about what we now refer to as the “Corona trade” in the winter/spring of 2020. The U.S. stock market had peaked on February 19 when the news of the pandemic hit the news cycle. Thus began a nerve-wracking slide in securities prices that lasted about a month, with the market finally bottoming on March 23. There was a great deal of uncertainty for investors to absorb – a brand new virus, fatal to some, with no known effective treatment and, at that point in time, no vaccine. Global travel was severely impacted, and certain industry sectors came to a grinding halt as disease containment and abatement measures began to be employed. The duration of this event was, at that point in time, unknown. For a time, securities were priced as if we would forever be in “pandemic mode.” Think about how things are remarkably different a bit more than 2 years later. However, right now we are absorbing continuous news of the considerable distress being created by the Russian invasion of Ukraine. How much longer will it go on? How will it end? These are questions without answers in the present moment.

- During these challenging times, we think the heathiest response is to focus on what you control. You control your spending. You control what information you consume. You control your portfolio’s investment allocation, which was constructed in partnership with us and with the expectation that recessions and bear markets will occur. While it can be uncomfortable to live through, none of this is unexpected nor outside the realm of what happens in healthy capital markets.

The quarter ended June 30th was awash in a sea of red as all major asset classes traded lower, as seen in the table below.

| Asset Class | Index | Q2 Return | Year to Date Return as of 6/30/2022 |

| U.S. Large Stocks | S&P 500 | -16.1% | -20.0% |

| U.S. Small Stocks | Russell 2000 | -17.2% | -23.4% |

| International Developed Stocks | MSCI EAFE | -14.3% | -19.3% |

| Emerging Markets | MSCI Emerging Markets | -11.3% | -17.5% |

| Bonds | Barclays Aggregate Bond | -4.7% | -10.3% |

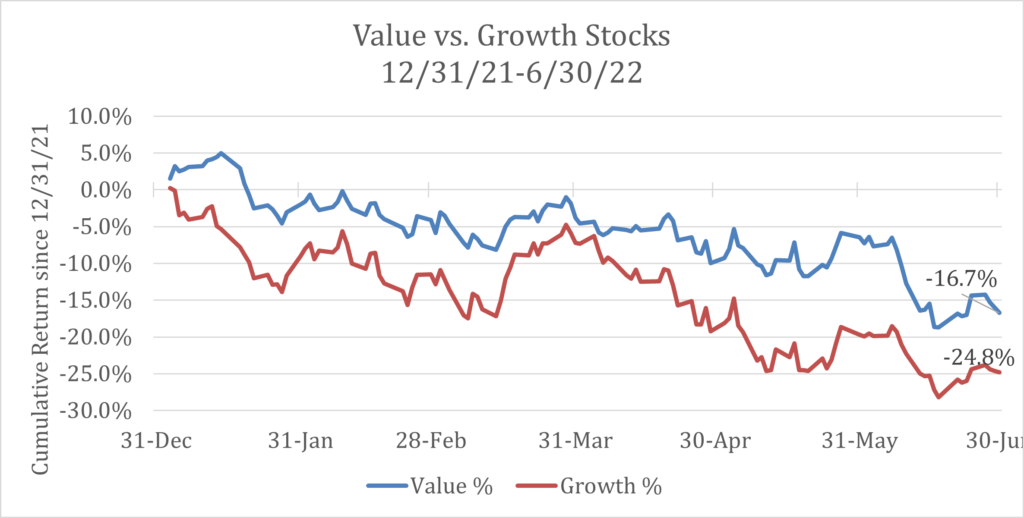

During the second quarter, investors fled both stocks and bonds over the dual fears of prolonged inflation and potential recession. We continue to find comfort in knowing that our money managers aim to invest in companies with strong financial positions and whose stock prices are reasonable relative to earnings expectations. As the graph below shows, these “value” stocks (blue line) have continued to hold up better against “growth” stocks (red line), with value’s relative outperformance becoming more pronounced as the drumbeat of recession grew louder and investors sought shelter in companies with lower perceived risks.

Value Stocks Continue Outperformance vs. Growth

Source: Yahoo! Finance (Value stocks represented by ticker VLUE and growth stocks by ticker MTUM)

Bear Market History Lessons

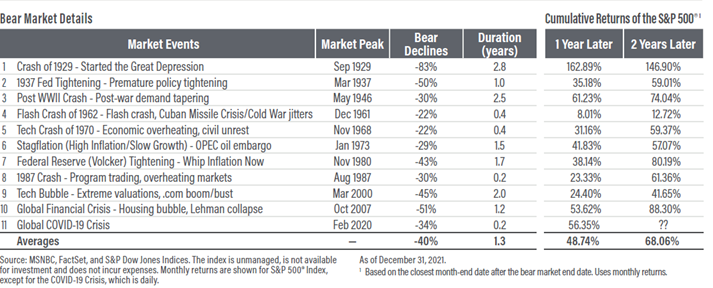

We think taking a historical perspective can be helpful to countering the uncomfortable emotions that arise during significant market declines. It is easy to forget past bear markets, their depth and duration, as well as the times that followed them. The table below summarizes the bear markets of the past 100 years, and we hope demonstrates that these events have occurred with regularity as capitalism exhibits its natural cycles of boom and bust.

While the cause of each bear market is unique, during each decline the stock market has, on average, fallen -40% over 1.3 years before rebounding with cumulative gains of +68% over the next two years.

Behavioral Finance: Temptations We Face

Investors with diversified portfolios are experiencing a double dose of pain this year as both stocks and bonds have posted significant losses.

Market participants are often tempted to change their investing game plan, and not just in bad times. Even when times are good, investors may be tempted to go after what is soaring. In the past few years, we have witnessed stratospheric gains in fake cryptocurrencies, meme stocks, and a few COVID stock plays that “went to the moon.” We read stories of kids (probably still living in their parent’s basement) striking it rich. This can frustrate the disciplined investor who has made money, but not that kind of money!

Observing others win the “stock market lottery” will naturally tempt us to abandon our plan and chase better performance. After all, those eye-popping returns would enable us to retire earlier or enhance our retirement lifestyle.

Behavioral economists tell us that the euphoria we experience with a gain is quickly overshadowed by the pain we feel with financial loss. This explains why many investors are quick to sell investments after they’ve declined. We are ingrained as humans to protect what we have — our home, our loved ones, and our investment portfolio. The overriding feeling is that we cannot, in good conscience, sit idly as our portfolio is decimated.

The greatest challenge to dealing with our emotions during a market downturn is that we don’t know what the future holds. We don’t know if the current market environment is just a correction or the start to a brutal bear market. If we knew the market would go down 40% from its highs, and we knew when it would turn, we could protect our assets and then put them back to work when it became safe. Unfortunately, we don’t know, and neither do the “experts,” because market path can’t be predicted.

Investors who “protect” themselves by moving their portfolio to cash eliminate the risk of losing money tomorrow, but greatly increase the risk of not reaching their goals. This is because no one knows when the bottom will occur. When the market inevitably rebounds, who knows if it is just a short-term rally in a bear market or the start of a bull market? When will you know? What will give you the “all clear” signal? At what point will you realize that the bull market train has left the station and you aren’t on board?

So, what is an investor to do?

We firmly maintain that investors need to develop an investment strategy and trust it. To this end, we devote significant time at the beginning of client relationships to educate you on the history of financial markets and how this history influences our chosen investment philosophy. Whether markets are going up or down, there is always something performing better than what you own in your portfolio. However, we don’t think investing is about owning those things that do best every single moment – that is impossible. Investing is about owning a portfolio of securities that you can hold in good and bad times – because we have chosen a strategy matched to your financial needs and goals that is built to perform stably over time as the market rises and falls. You know what you own, why you own it, and don’t care what the market is doing.

Your portfolio has been designed to meet your long-term financial goals. If you have any questions about the process, strategy, or portfolio itself, please let us know.

Firm Update: Welcoming Hunter Outen

Who Can We Help?

For more than 29 years, we have helped guide individuals and families to their financial goals. As a result, our business now comes to us primarily through referrals. If you know a friend, colleague, or family member who could benefit from one of our many services, we hope you’ll invite them to visit our website to learn more about us and schedule a complimentary consultation.

Our services:

- Retirement Readiness

- Investment Allocation

- Paying for College

- Social Security Planning

- Retirement Community Consultations

- Philanthropic and Family Legacy Planning

Please remember to contact us if there are any changes in your personal financial situation or investment objectives so that we may review your long-term investment strategy. As always, we welcome your phone calls and emails should you have any questions or would like any further information.

We appreciate the opportunity to serve you and are grateful for the trust you place in us as stewards of your financial resources.

Very truly yours,

Mark A. Kuhn & Scott W. Ranby