Highlights

• Market Update: Higher Interest Rates for Longer?

• Implications of Higher Interest Rates

• Value Investing 101

• Behavioral Finance: Magnifying the Present

• Firm Update: Welcoming Jackson Allen, CFP®

Market Update: Higher Interest Rates for Longer?

After weathering the potential U.S. government debt default earlier this summer, financial markets returned their focus to the Federal Reserve’s interest rate policy. During the third quarter, investors soured on most asset classes as various economic reports revealed continued robustness in the labor market, thus increasing the odds that interest rates will need to stay at elevated levels longer than anticipated in order to reduce inflation to the Federal Reserve’s 2% target.

Below are returns for the major asset classes for the quarter and nine months ended September 30th, 2023.

| Asset Class | Index | Q3 Return | YTD through 9/30/23 |

| U.S. Large Stocks | S&P 500 | -3.3% | +13.1% |

| U.S. Small Stocks | Russell 2000 | -5.1% | +2.5% |

| International Developed Stocks | MSCI EAFE | -4.0% | +7.6% |

| Emerging Markets | MSCI Emerging Markets | -2.8% | +2.2% |

| Bonds | Barclays Aggregate Bond | -3.2% | -1.2% |

Implications of Higher Interest Rates

In our view, higher interest rates are not something to be feared, but rather acknowledged as creating both positive and negative effects for the economy, including:

Positives

• Reducing speculative behavior by both consumers and businesses, which may reduce the risk of financial market bubbles.

• Providing savers the ability to earn higher yields with less risk. Currently, several online banks are offering FDIC-insured money market funds paying 4.3%-5%.

• Encouraging stock buyers to focus on company fundamentals such as debt levels, pricing power, and the ability to manage through economic cycles.

Negatives

• Increasing the cashflow strain on highly indebted households and businesses.

• Dampening certain economic activity, such as home buying.

• Discouraging investment in new technologies, such as clean energy.

Value Investing 101

For the foreseeable future, we expect that higher interest rates will encourage investors to focus more on both company fundamentals and the prices they pay for stocks. This heightened scrutiny of company traits and stock values is already a regular practice of our money managers, who to one degree or another follow what’s known as the value style of investing. In our view, the basic tenet of value investing is recognizing that the most important variable in one’s ultimate return on any asset is the initial price paid to purchase it. Whether the investment in question is a house, fine art, or a stock, an investor’s only shot at making a positive return is to ensure the purchase price is low enough such that, over time, other market participants come to value the asset, thereby bidding up its price in the process. More plainly, we think the best way to successfully invest is to “buy low and sell high.”

Our money managers attempt to execute this process of buying low and selling high as they scour the universe of stocks to populate their portfolios. While most people would agree with the wisdom of buying something when its price is low (after all, who doesn’t enjoy finding bargains on clothes, electronics, or gifts?), the issue with stocks is that they sometimes may be “cheap” for justifiable reasons. Such causes might include a negative quarterly earnings report, poor management decisions, or perhaps a product recall or lawsuit. Less dire, but equally negative trends in a company’s stock price can be caused by current economic conditions or a cloud of negative sentiment over an entire industry.

Such events can drive a stock price down, causing current holders of the stock to incur a loss and some stock pickers to look for greener pastures. Value-oriented money managers, however, relish the chance to go “bargain shopping” for companies with sound fundamentals and ignore the headline reason for the decline in an attempt to tease out whether the underlying event is a permanent or temporary phenomenon. These managers look beyond the effects of the current economic environment or management team and find hidden opportunities waiting to be unlocked in the company if new conditions prevail. Such a catalyst for a rebound in the stock price could be an improving economy, a new management team, or being acquired by another company.

Having outlined the premise of value investing, how does one go about identifying a “value” stock? There is no singular definition, but value stocks usually trade at market prices below what their fundamentals, such as earnings or asset values, would imply. A common measure of a stock’s value relative to its peers is the price-to-earnings ratio (P/E ratio), which is computed by dividing a stock’s current share price by the company’s earnings per share. Thus, a company that earns $2 per share and trades at $14 per share would have a P/E ratio of 7, which implies that an investor pays $7 to gain access to every $1 of company earnings. By contrast, another company in the same industry that earns $3 per share, but trades at $60, has a P/E ratio of 20. Buyers of this latter company’s stock are hoping that, despite paying more per $1 of earnings than they would if they bought the first company, their company can grow faster in the future through such means as expanding into new markets or introducing new products. By contrast, buyers of the lower P/E ratio stock are not necessarily expecting the company to make outsized strides in growth, but rather to continue delivering measured, incremental earnings growth.

While P/E ratios can and do vary across industries and time due to growth prospects and investor attitudes towards the future, all else being equal, most rational investors would rather pay less per dollar of earnings than more. P/E ratios can fluctuate due to factors affecting either the numerator of the equation (price) or the denominator (earnings). The stock price is also influenced by investor interest, profit expectations, or the anticipation of a future event such as a new product or an announcement of a merger or acquisition. The company’s earnings are driven by the sales from new products or markets or as a result of cost-cutting measures. The table that follows shows the P/E ratios for a selection of large company stocks and provides an indication of the range of P/E ratios found in the stock market today.

P/E Ratios of Selected Stocks

Company P/E Ratio as of 10/12/2023

Nvidia 113

Tesla 75

Apple 30

S&P 500 Index (average) 18

Campbell Soup 14

UPS 13

Nissan 9

Source: Morningstar.com

To summarize, value investors look for quality stocks that are temporarily depressed for specific reasons such as a negative earnings quarter, poor management (who can be replaced!), product recall, etc. Other characteristics of value stocks include slower growth but good cash flows, predictable earnings, and frequently pay dividends.

In contrast, growth stocks are often priced with the expectation that the company will perform better than average. These companies must meet lofty expectations simply to justify their current share price and the smallest hiccup can cause the stock price to tumble. Value stocks, on the other hand, often have lower growth expectations, and worst-case scenarios may already be reflected in the price, so even slightly positive news can cause the stock to rally.

So, What’s in it for Me?

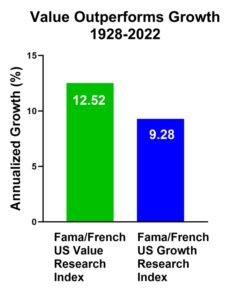

The benefit of a value-oriented investment style shows in the historical performance of value stocks relative to their growth counterparts. The chart on the following page reveals that from 1928-2022, value stocks outperformed growth stocks by a wide margin. Among large company stocks, value stocks gained an average of 12.5% annually vs. 9.3% for growth stocks.

The key explanation for these startling results is that value stocks generally have more predictable cash flows and so are less dependent on future growth to support their current stock prices, thus they tend to hold up better during times of market turbulence. By not losing as much during market downturns as growth stocks, value stocks as a group typically have less of a hole to dig out of during good times in order to produce positive compounded returns.

Source: Dimensional Fund Advisors

Value Investing can be a Lonely Road

Of course, if value investing were easy, then everyone would adopt it as an investing strategy. The reality is such a contrarian approach requires discipline, patience, and a willingness to go against the crowd and its popular wisdom. The hidden value within a company may take time to manifest to the larger investment community. Furthermore, companies going through rough patches may see their “cheap” stocks get even cheaper, further testing the conviction and patience of a value investor. Finally, during euphoric times in the stock market, value stocks often trail their growth brethren by large margins, as was the case in the late 1990s and most of the 2010s. Over long periods of time, however, we continue to think that a value-oriented investment strategy provides investors with the best opportunity to achieve market-beating returns with lower volatility. One of our fund managers has referred to value investing as “time arbitrage,” a reference that gives a good summation of this investment discipline.

Behavioral Finance: Magnifying the Present

Over the past few months, investors have been confronted with a litany of worries, including:

• U.S. Government debt default

• Potential federal government shutdown

• Restarting of student loan payments for millions of workers

• Nearly 8% interest rates on home mortgages

• War in Europe and the Middle East

It is human nature to focus more on the present than the future, which is in line with our basic instinct of survival. We focus on the present because that is where “life happens” and we experience feelings such as pleasure, pain, anxiety, and peace. Every day we face cost-benefit tradeoffs that not only impact our lives today, but potentially for years to come. By focusing on the present, we often select those things that bring immediate gratification while delaying its cost into the future.

Investing Tradeoffs

Perhaps the most frequent and material tradeoff investors face is whether to sell investments when markets go down and the outlook is negative (doing so allows one to receive immediate emotional relief) or remain disciplined to the strategy even as account values go down. The former is easy, the latter requires conviction and perseverance. The tradeoff comes down to emotional comfort today vs. potential for greater long-term returns. As Peter Lynch, one of the most successful money managers of all time, once remarked:

“The real key to making money in stocks is not to get scared out of them.”

Smart Today May Not Be Smart Tomorrow

We tend to extrapolate the present into the future, as if things will never change. When times are good, we feel good and may underestimate the risk. When things are bad, it’s about how much worse things are going to get – especially when presented with exaggerated headlines that feed into the doom and gloom.

But things change – they always do. We don’t know when or what may cause the change, but markets and economies are cyclical. What may seem smart today could end up being unwise and costly down the road. That is why your wealth plan is so important. It is the anchor that helps us bridge the present to the future and helps us make sure the decisions we make today will be in your best interest tomorrow.

© The Behavioral Finance Network

Firm Update: Welcoming Jackson Allen, CFP®

We are pleased to introduce our newest team member, Jackson Allen, who joined us in August as an Associate Wealth Advisor. Jackson is a graduate of Campbell University, where he received his undergraduate degree in Trust and Wealth Management as well as his MBA. Jackson has three years of wealth management experience and is a Certified Financial Planner ® professional. We know his positive personality and client service mindset will benefit our firm and clients, and we look forward to introducing you to him.

Who Can We Help?

For 30 years, we have helped guide individuals and families toward their financial goals. As a result, our business now comes to us primarily through referrals. If you know a friend, colleague, or family member who could benefit from one of our many services, we hope you’ll invite them to visit our website at www.KuhnAdvisors.com to learn more about us and schedule a complimentary consultation.

Our services:

• Retirement Readiness

• Investment Allocation

• Paying for College

• Social Security Planning

• Retirement Community Consultations

• Philanthropic and Family Legacy Planning

Please remember to contact us if there are any changes in your personal financial situation or investment objectives so that we may review your long-term investment strategy. As always, we welcome your phone calls and e-mails should you have any questions or would like any further information.

We appreciate the opportunity to serve you and are grateful for the trust you place in us as stewards of your financial resources.

Very truly yours,

Mark A. Kuhn Scott W. Ranby