Highlights

• Market Update: Hopes Rise for a Soft Landing

• Narrowness of U.S. Stock Leadership

• AI: Is the Hype Real?

• Behavioral Finance: How Will You React to the Next 30% Market Decline?

Market Update: Hopes Rise for a Soft Landing

Financial markets traded sideways for most of the spring until a resolution to the debt ceiling crisis was reached in early June. While the agreement was more of a band-aid than a long-term solution, it was enough to spur a rally across most asset classes. Furthermore, encouraging data on the U.S. labor market bolstered confidence in the Federal Reserve’s ability to reduce inflation while avoiding a recession, the Goldilocks scenario known as a “soft landing.” Currently, market participants expect the Fed to raise interest rates one or two more times this year.

Below are returns for the major asset classes for the quarter and six months ended June 30th, 2023.

Narrowness of U.S. Stock Leadership

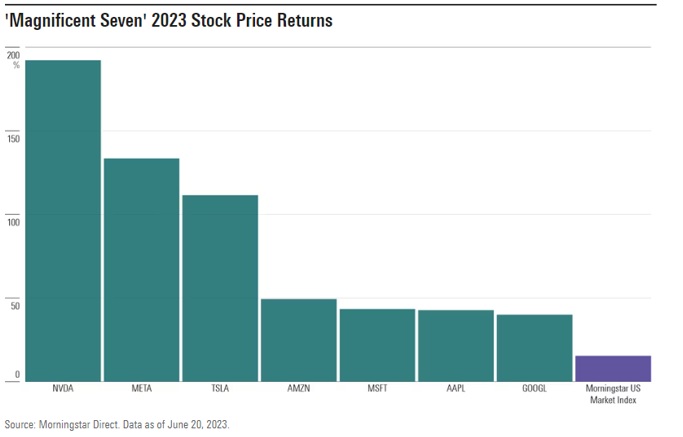

While the U.S. stock market benchmarks posted robust returns in the second quarter, upon closer inspection one finds that these gains were mostly attributable to just a handful of firms. These companies, labeled by some as the “Magnificent Seven,” consist of Nvidia, Tesla, Meta Platforms (formerly Facebook), Apple, Amazon.com, Microsoft, and Alphabet (formerly Google). The chart below shows each stock’s year-to-date return through 6/20/2023 compared to the US market as a whole.

All seven stocks suffered significantly during 2022 as the Federal Reserve’s aggressive interest rate hikes made their future profits less valuable to investors. Tesla fared the worst, declining 65%, and Meta was close behind, falling 64%. Nvidia and Amazon both lost 50%, while Alphabet declined 39%. Shares for Microsoft and Apple lost the least, losing close to 25%.

Thus far in 2023, these stocks have bounced back in a big way. As of June 20th, Nvidia has climbed 192%, Tesla stock is up 112%, and Meta stock has gained 134%. Gains on shares of the other companies are above 40%.

For many of these stocks, a key driver of their eye-popping returns has been investor enthusiasm over the potential role these firms will play in the burgeoning field of “artificial intelligence.” While the “idea” of artificial intelligence has been bandied about for quite some time, its actual use has been growing recently and investors have become attracted to companies expected to benefit from increased use of this new tool. For example, Nvidia has rallied on speculation of increased demand for its chips, which have been used to train programs like Open AI’s ChatGPT. Microsoft, Alphabet, Apple, and Meta have also ventured into the use of AI tools to furnish their products and services.

While AI certainly has the potential to be a major profit source for these companies in the future, it’s fair to ask if the current expectations built into the stock prices of these companies might have gotten ahead of fundamentals. Furthermore, healthy stock markets generally consist of a wide range of rising stocks, not just those confined to a particular industry. As Morningstar’s head U.S. market strategist, David Sekera, has remarked,

“This indicates to us that this trend has essentially run its course for now. In order for the market rally to continue in the second half of the year, we would expect to see that rally broaden out into other sectors and categories.”

AI: Is the Hype Real?

As mentioned above, Nvidia is one of several companies that has ridden the wave of investor enthusiasm over “the next big thing,” artificial intelligence and machine learning. As of this writing, Nvidia’s stock trades at an astronomical price to earnings ratio of 222, compared with 20 for the average large U.S. stock. Since A.I. has exploded into the public consciousness over the past few months, we thought it worthwhile to give an overview of this technology and its disruptive potential across all industries. Please note that the following text was produced by querying ChatGPT to illustrate the functionality of this artificial intelligence tool.

Artificial Intelligence (AI) has the potential to impact a wide range of professions and industries. While the exact extent of its impact may vary, here are some professions that are likely to be affected significantly by AI:

1. Transportation: Autonomous vehicles are expected to disrupt the transportation industry, potentially reducing the need for certain types of jobs, such as long-haul truck drivers or taxi drivers.

2. Manufacturing and Robotics: AI-powered automation and robotics are transforming manufacturing processes, leading to the automation of repetitive tasks. This can impact jobs in assembly lines, quality control, and warehouse operations.

3. Customer Service and Support: AI chatbots and virtual assistants are increasingly used to handle customer inquiries and support requests. This could reduce the demand for certain customer service roles.

4. Healthcare: AI has the potential to revolutionize healthcare by assisting in diagnosis, drug discovery, and personalized medicine. While it may not replace doctors, it can augment their capabilities and change the nature of some healthcare roles.

5. Financial Services: AI is already being utilized in areas like fraud detection, algorithmic trading, and customer service in the financial industry. This can lead to changes in job requirements and the need for new skill sets.

6. Legal Services: AI-powered tools can assist with legal research, document review, and contract analysis, potentially impacting certain roles in the legal profession.

7. Data Analysis and Insights: AI can automate data analysis tasks, enabling faster and more accurate insights across various industries. This could affect jobs in data entry, data analysis, and data interpretation.

8. Journalism and Content Creation: AI can generate news articles, summaries, and reports based on large datasets. While it may not replace journalists, it could impact certain aspects of content creation and news reporting.

9. Retail: AI-powered technologies like cashier-less stores, personalized recommendations, and inventory management systems can impact jobs in traditional retail settings.

10. Education: AI has the potential to personalize and enhance the learning experience, automate administrative tasks, and provide virtual tutoring. This could affect roles in teaching, curriculum development, and administrative tasks.

It’s important to note that while AI may automate certain tasks and job functions, it can also create new opportunities and demand for skills related to developing, implementing, and maintaining AI systems. The overall impact of AI on professions will depend on various factors, including the rate of adoption, ethical considerations, and the ability of individuals and organizations to adapt to the changing landscape.

After reading the foregoing, here are some observations that we make.

1) It is a technology that is being fed previously expressed and published content and then furnishing very general and non-specific statements about what might happen in this new landscape. We do not see evidence of generative thinking or synthesis of truly new ideas.

2) We have seen examples of AI-generated material that is unsupported by factual information which led to submission of a totally false legal fact-set in support of a lawsuit.

3) We think the predictive powers of AI are still unproven at present.

Behavioral Finance: How Will You React to the Next 30% Market Decline?

This spring, the popular financial publication Barron’s asked investors to rank their most pressing concerns regarding financial markets in the coming months. The top responses were as follows:

Recession

Government debt ceiling

Bank failures

Persistent high inflation

Whether or not these events materialize is not as important to stock prices as simply the recognition that these risks exist. The stock market is a forward-looking mechanism and, as such, it incorporates these potential risks into prices the moment they are conceived. Furthermore, some of the worst historical market declines were induced by circumstances few had pondered, such as 2008’s sub-prime mortgage crisis and 2020’s pandemic, to name the two most recent such events.

After the market’s remarkable recovery from the depths of the COVID-19 pandemic, we think it’s prudent to ask: How mentally prepared are you for the next major market downturn?

Experience tells us that stock declines are integral to investing, with 5% to 10% selloffs occurring regularly, and drops of 20%, 30%, or more occurring about once every decade. Whether that decline happens next week, next month, or 3 years from now is anyone’s guess. While it is tempting to predict the cause of the next sell-off in an effort to maneuver around it, the inescapable truth is that, by definition, pullbacks are unexpected.

The trigger for each devasting market decline is never exactly the same, but the consequences are. Investors will wake up to disturbing news and our reptilian instincts will trigger the fight- or- flight response, taking the form of indiscriminate stock selling and asking questions later. Such behavior can lead to the very real risk of converting a temporary decline in wealth to a permanent one.

Steps to Take Now

Envision a market decline. Visualize waking up to news headlines reading “stocks in free fall,” with articles full of words such as “carnage,” “2008,” “crash,” and “panic.” These headlines will be accompanied by stock photos of Wall Street traders burying their heads in their hands and quotes from “market experts” attempting to explain what happened.

Write down your action plan if stocks fall 5%, 10%, or 20%. Will you turn off the 24- hour news channel or tune in for the gory details? Will you call us to sell your portfolio or think back to how such a strategy in 2008 or 2020 would have resulted in long-term negative outcomes? Will you be eager to invest extra cash to take advantage of bargains?

Revisit your investment goals. During our meetings with you, we continually assess your portfolio in light of anticipated lifestyle changes or financial goals. This knowledge influences our recommendations for conservatively vs. growth-positioned investments.

Remember that the good times in stocks won’t last forever and that future opportunities are born out of stock declines.

When the next bout of turbulence hits stocks, our counsel will be to remain calm and not make any rash decisions. Behavioral finance experts tell us that once our brains process negative news, the fear of loss can quickly override any rational thoughts and behaviors. All we can think about is fleeing to safety and finding refuge.

What will we do when the day of reckoning comes? We’ll start by having conversations with our fund managers to get their take on current events and the stocks in their portfolios. We’ll send out a message very similar to this one reminding you to view the events from the larger perspective of past stock market history. Finally, we will gladly revisit your financial plan with you to assess your progress towards your financial goals.

Who Can We Help?

For 30 years, we have helped guide individuals and families toward their financial goals. As a result, our business now comes to us primarily through referrals. If you know a friend, colleague, or family member who could benefit from one of our many services, we hope you’ll invite them to visit our website at www.KuhnAdvisors.com to learn more about us and schedule a complimentary consultation.

Our services:

• Retirement Readiness

• Investment Allocation

• Paying for College

• Social Security Planning

• Retirement Community Consultations

• Philanthropic and Family Legacy Planning

Please remember to contact us if there are any changes in your personal financial situation or investment objectives so that we may review your long-term investment strategy. As always, we welcome your phone calls and e-mails should you have any questions or would like any further information.

We appreciate the opportunity to serve you and are grateful for the trust you place in us as stewards of your financial resources.

Very truly yours,

Mark A. Kuhn Scott W. Ranby