HIGHLIGHTS

- Office COVID-19 Update: Virtual and In-Person Meetings Available

- Market Update: Volatility Surges on War and Inflation News

- Taking the Pulse of the U.S. Economy

- Behavioral Finance: 3.5 Obstacles to Successful Investing

Office COVID-19 Update: Virtual and In-Person Meetings Available

As infection rates decline to manageable levels, we feel comfortable offering in-person meetings this quarter for clients who are fully vaccinated and boosted. We will also continue offering meetings via Zoom video and phone calls. Please choose the format that suits your preference and schedule.

Market Update: Volatility Surges on War and Inflation News

The quarter ended March 31st was awash in a sea of red as all major asset classes traded lower, as seen in the table below.

| Asset Class | Index | Q1 Return | Year to Date Return |

| U.S. Large Stocks | S&P 500 | -4.6% | -4.6% |

| U.S. Small Stocks | Russell 2000 | -7.5% | -7.5% |

| International Developed Stocks | MSCI EAFE | -5.9% | -5.9% |

| Emerging Markets | MSCI Emerging Markets | -7.0% | -7.0% |

| Bonds | Barclays Aggregate Bond | -5.9% | -5.9% |

During the first quarter, investors agonized over the dual threats of persistently higher inflation and, more tragically, news that Russia had invaded Ukraine. Like you, our hearts go out to all those who are suffering untold hardships because of this war.

A silver lining to these grim performance figures was that this market shake-up was an opportunity to be reminded of the benefits of our value style of investing. Value stocks, those shares trading at lower prices relative to their earnings, held up better than growth stocks.

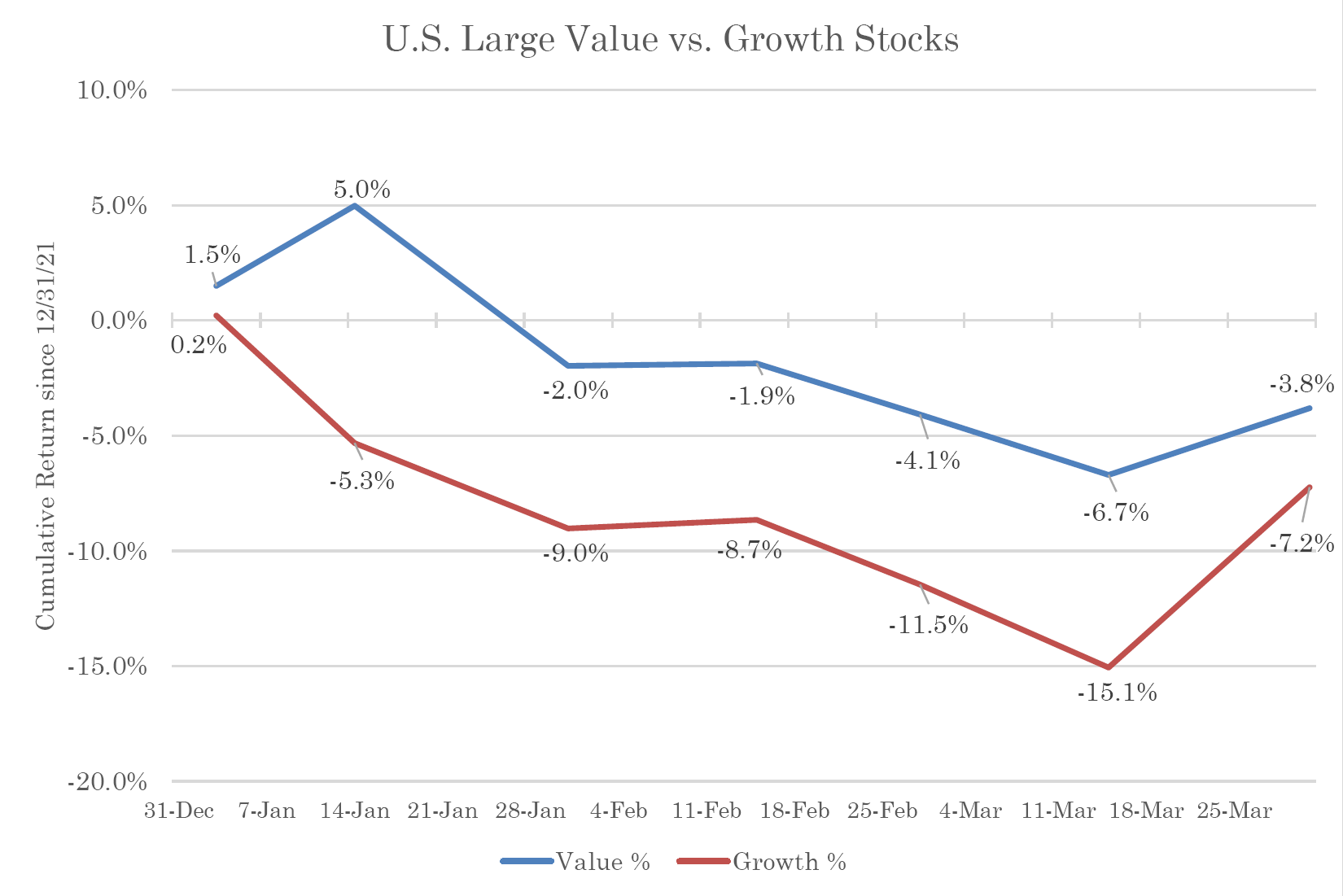

As the graph below shows, value and growth stocks began the new year headed in opposite directions: by mid-January, value shares were up 5% compared with a -5% decline in growth stocks. As the quarter progressed, investors abandoned stocks in general in response to persistently high inflation readings and Russian aggression. Value stocks, however, followed their historical pattern of declining less than their growth peers during times of market stress, ending the quarter down only -3.8% as compared with -7.2% for growth.

Value Fares Better than Growth

Source: Yahoo! Finance (Value stocks represented by ticker VLUE and growth stocks by ticker MTUM)

Taking the Pulse of the U.S. Economy

Financial market participants continue to fret over the U.S. economy’s ability to withstand higher interest rates as the Federal Reserve seeks to restrain the rapid rise in consumer prices. In March, the Fed raised short-term interest rates by 0.25%, the opening volley in its inflation-fighting campaign, and signaled that further hikes will be warranted to achieve a target rate of nearly 2.0% by year-end. While there is valid concern that these rate increases will slow economic growth, the data thus far portray promising signs in the domestic labor market:

- The U.S. added 400,000 new jobs in March, following a 750,000 gain in February.

- The unemployment rate fell to 3.6%.

- Average hourly wages rose 5.6% from a year ago.

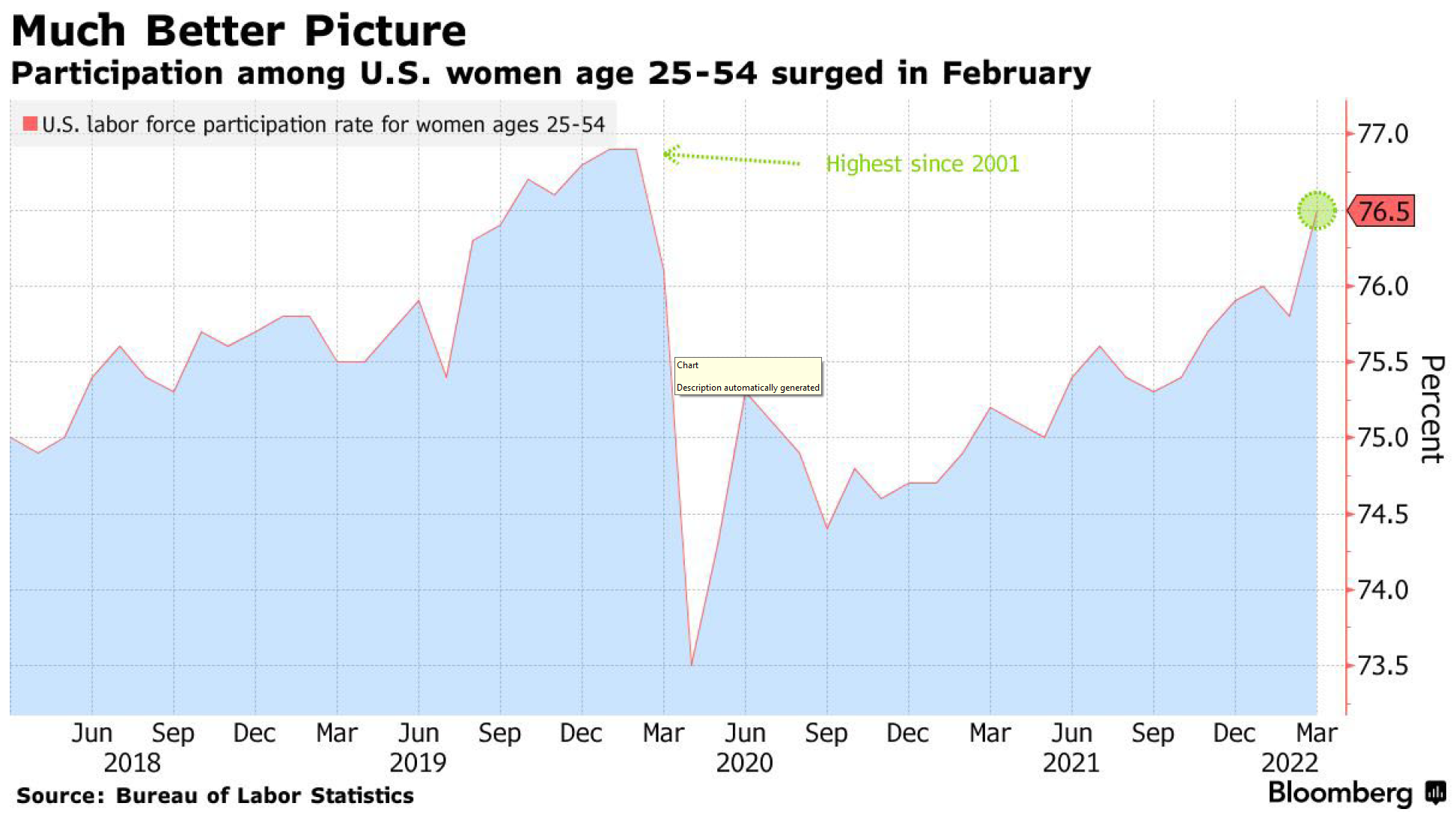

Even more encouraging are signs that women, who bore a disproportionate share of the job losses during the pandemic, are finding their way back into the labor market. As the chart below shows, 76.5% of women between the ages of 25 and 54 are actively employed or seeking a position, a stark rebound from the lows of March 2020.

Source: Bloomberg

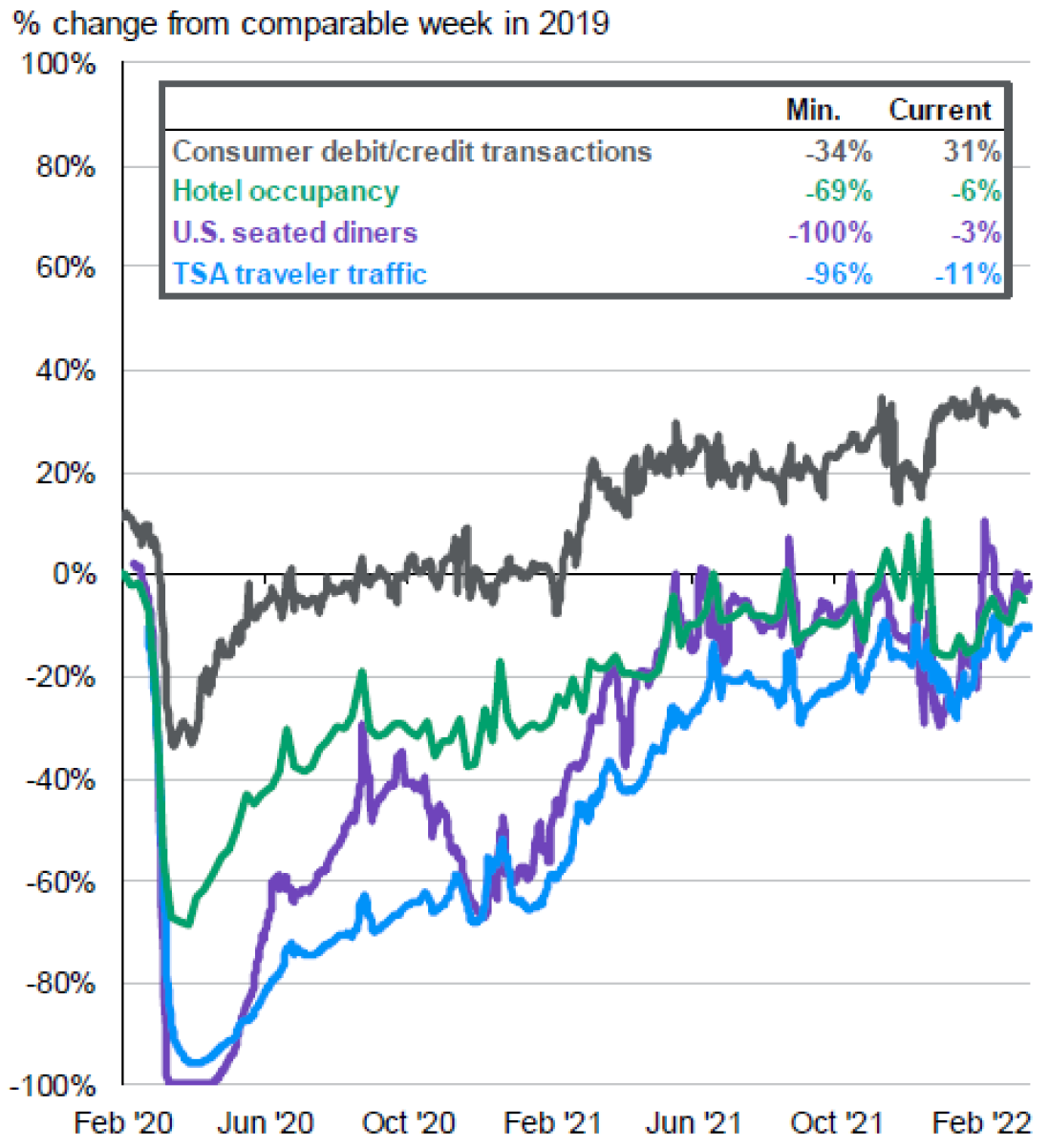

The U.S. economy’s resurgence from the pandemic is further illustrated by the strong bounce back in consumer activity, as seen in the trends that follow.

Source: JPMorgan Guide to the Markets Q2 2022

Yes, Bonds Can Lose Money

Investors may do a double take this quarter when reviewing their bond holdings and finding these normally staid investments posted a loss for the quarter, as evidenced by the nearly 6% decline in the primary bond market benchmark, the Barclays Aggregate Index. This negative performance was precipitated by expectations that the Federal Reserve will need to raise interest rates faster and higher in the face of elevated inflation, thus causing the value of existing bonds, which pay a lower interest rate, to fall.

While we understand the frustration of witnessing drops in more conservative investments, we are quick to point out that bonds continue to play an important role in portfolios. First, they act as a diversifier to stocks, serving as an insurance policy against major stock market declines. Second, as interest rates rise in the quarters ahead, new bonds will be issued at higher yields, thus producing more income for bondholders. Therefore, our counsel with bonds is the same as when stocks decline, that is, we advise staying the course and distinguishing between temporary fluctuations in bond prices and the health of the underlying businesses. After all, if the bond issuer remains solvent, bondholders should expect to be paid back.

While we wait for the bond market to stabilize, we are taking steps to mitigate the negative effects of rising interest rates by choosing bonds with shorter maturities and higher starting yields.

Behavioral Finance: 3.5 Obstacles to Successful Investing

Regular readers of our newsletters know we often discuss the potential for our emotions to impede the achievement of our financial goals. After all, as humans, we are wired for emotional, not rational, decision making. Our flight-or-fight response has enabled our species to thrive for millennia, serving as an early-warning system to detect and respond rapidly to danger. Unfortunately, in today’s modern world, this primitive mechanism struggles to distinguish between imminent bodily harm brought on by, say, a saber-tooth tiger versus the loss of our portfolio’s value.

While it may not be possible to prevent emotions from bubbling up when our money is at stake, we think avoiding the following three and a half obstacles we describe below reduces the chance of those feelings of anxiety, greed, and fear of loss derailing financial dreams.

#1 Media Influence

The financial media’s raison d’être is to sell airtime to advertisers. They do this by creating content under the guise of helping investors “stay up-to-date” with the “latest” economic and financial news and by employing attractive men and women to deliver it nearly around the clock.

Unfortunately, these talking heads know nothing about your unique financial circumstances and goals, not to mention your risk tolerance, current portfolio value, and asset allocation. We therefore strongly suggest tuning out this day-to-day noise and focusing on the one thing under your control: the creation and implementation of a sound financial plan.

#2 Temptation of Market Timing

Investors tuned into the 24/7 news cycle may be tempted to predict the market’s highs and lows, a concept known as market-timing. The appeal of market-timing is obvious—selling out of stocks right before their next decline and scooping them back up again at the bottom of the cycle would be a path to quick riches. However, timing the market consistently is extremely difficult, and, when done unsuccessfully (which is more likely), it can lead to a significant opportunity loss.

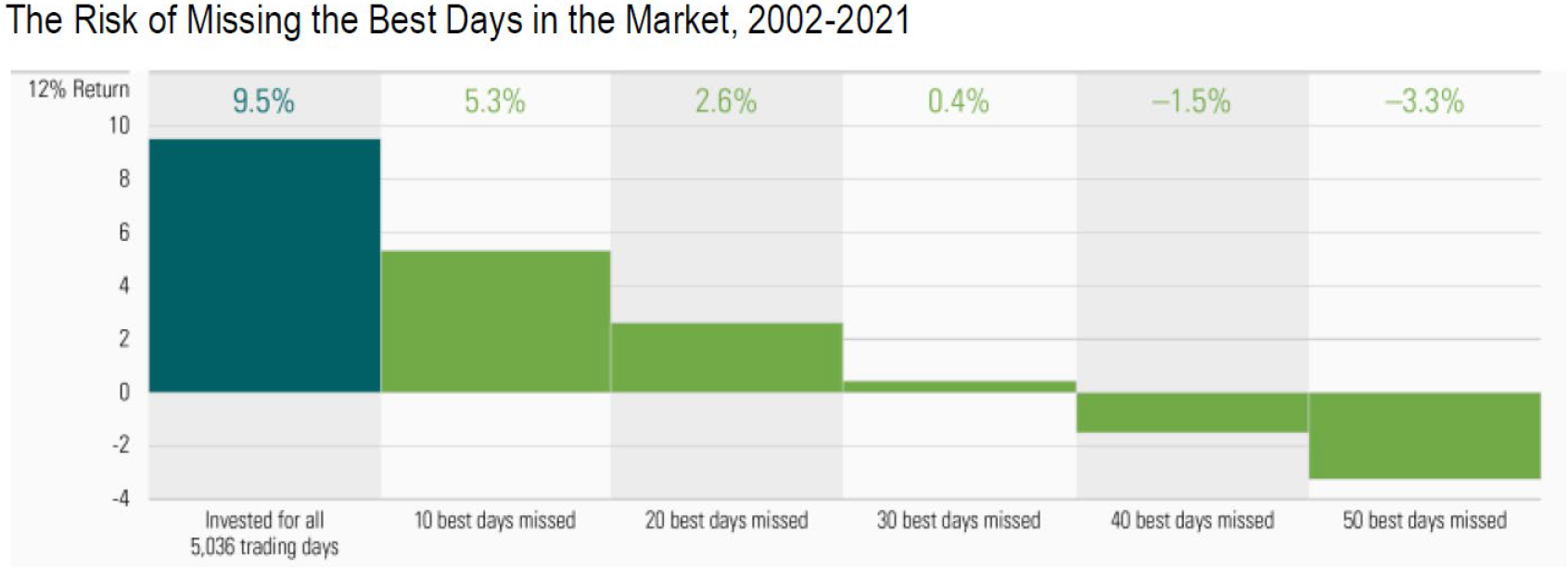

Investors who attempt to time the market run the risk of missing periods of exceptional positive returns, leading to significant adverse effects on the ending value of a portfolio. The graph below illustrates the risk of attempting to time the stock market over the past twenty years by showing the returns investors would have achieved if they had missed some of the best days in the market. Investors who stayed in the market for all 5,036 trading days achieved a compound annual return of 9.5% (see left-most bar). However, that same investment would have returned 5.3% annually had it missed only the ten best days of stock returns. Further, missing the fifty best days would have produced a loss of 3.3% (see right-most bar). Although the market has exhibited tremendous volatility daily, over the long term, stock investors who stayed the course have been amply rewarded.

#3 Fear of Volatility

Have you seen the above image before? It is the typical stock image seen on the nightly news or in the newspaper of a distressed trader after a major down day on Wall Street. Fluctuations in share prices, better known as volatility, are integral to the operation of the stock market and should not, in our opinion, be confused with investment risk. We define investment risk as the chance of either a permanent loss of capital or the failure to achieve one’s financial goals. We mitigate the former by partnering with money managers who invest in companies on solid financial footing and reduce the latter by developing a financial plan with each client that considers her unique goals and her tax, insurance, and estate planning dynamics.

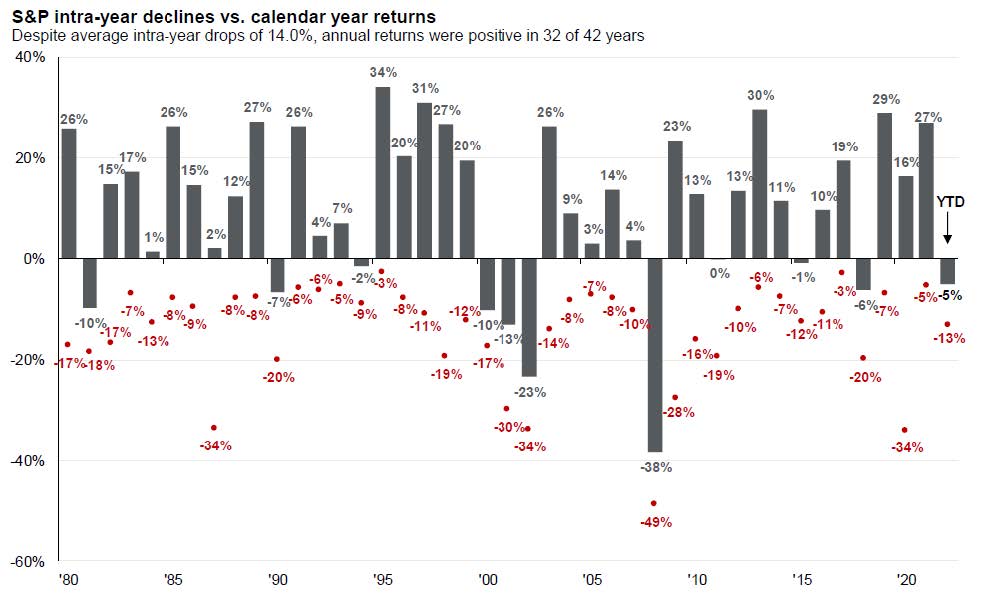

While watching stock prices decline can be nerve wracking, keep in mind that such declines are normal from a historical perspective. As the next chart shows, over the past 42 years, U.S. large stocks have fallen, at some point, 14% on average during a given calendar year (red numbers on the lower half of the graph). However, the U.S. market finished in positive territory in 32 out of those 42 years (black bars mostly on top half of the graph), or 76% of the time. The odds of successful investment are therefore very much stacked in the favor of those investors with the fortitude to stick with their strategy through the market’s ups and downs. Better yet, just let us at Kuhn Advisors watch the market’s daily gyrations while you tune out and enjoy a round of golf, a hike in the woods, or a lunch date with a friend!

Source: JPMorgan Guide to the Markets Q2 2022

Source: JPMorgan Guide to the Markets Q2 2022

#3.5 Having a Half-Baked Financial Plan

The final “half” obstacle to investment success is relying on a “half-baked” financial plan to achieve your goals, perhaps one that focuses solely on beating a particular market index or does not consider your estate, tax, and insurance circumstances.

Therefore, each of our clients has a comprehensive financial plan for accumulating wealth and then using it to support one’s goals, whether that be living comfortably, giving philanthropically, or leaving a legacy for family members. A foundational element of this plan is the creation of an Investment Policy Statement (IPS), one of which you signed at

the beginning of our relationship. This document outlines our agreed upon investment strategy with you and serves as guiderails for improving your odds of success. A primary feature of the IPS is the documentation of specific asset allocation parameters for your portfolio that consider your risk tolerance, financial objectives, and investment horizon.

Who Can We Help?

For more than 28 years, we have helped guide individuals and families to their financial goals. As a result, our business now comes to us primarily through referrals. If you know a friend, colleague, or family member who could benefit from one of our many services, we hope you’ll invite them to visit our website to learn more about us and schedule a complimentary consultation.

Our services:

• Retirement Readiness

• Investment Allocation

• Paying for College

• Social Security Planning

• Retirement Community Consultations

• Philanthropic and Family Legacy Planning

Please remember to contact us if there are any changes in your personal financial situation or investment objectives so that we may review your long-term investment strategy. As always, we welcome your phone calls and emails should you have any questions or would like any further information.

We appreciate the opportunity to serve you and are grateful for the trust you place in us as stewards of your financial resources.

Very truly yours,

Mark A. Kuhn & Scott W. Ranby