HIGHLIGHTS

- Office COVID-19 Status Update

- Market Update: Stocks Continue Their Run

- Inflation Has Finally Arrived (And Is Here To Stay?)

Office COVID-19 Status Update

After a long year of having our door physically closed to clients due to our COVID-19 safety protocols, we officially reopened the office in mid-May. All of us here have been fully vaccinated and are willing to meet with clients in the office, provided they are vaccinated as well. If you have been craving the Kuhn Advisors chocolate bowl, feel free to stop in and see us and grab a piece of candy. We continue to monitor infection rates in our area and are cognizant of the worsening hospitalization rate due to the more contagious Delta variant.As a result, we will be offering both in-person and Zoom meetings going forward. We recently sent you a survey to gather information about your meeting style preference (in-person, Zoom or phone call). We have become very comfortable with the ease of Zoom and will be offering it as an option for future meetings. Thank you to all of you who completed the survey to help make us more efficient.

Market Update: STOCKS CONTINUE THEIR RUN

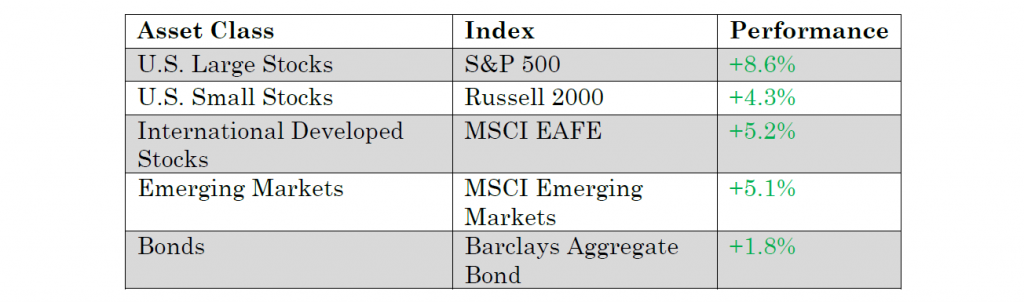

In the quarter ending June 30th, financial markets across the globe rose in tandem. In the table below, you can see that large U.S. stocks experienced the largest gain of the asset classes, while international markets and small U.S. stocks followed closely behind. Bonds bounced back nicely from a volatile first quarter.

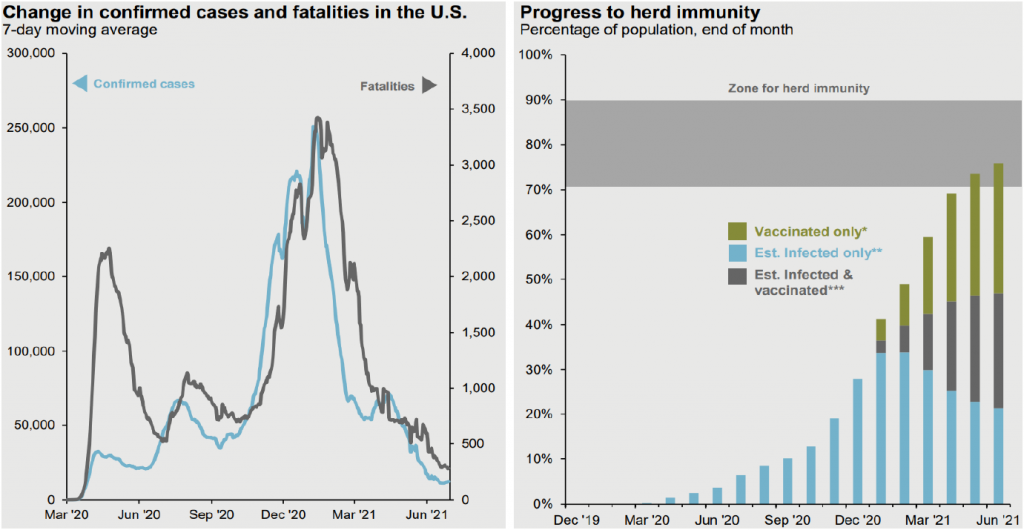

During the quarter, investors drove stocks to higher levels on the back of greater vaccination rates among adults and businesses and economies reopening after a year of uncertainty created by the spread of COVID-19. While the world still has a long way to go to heal from the pandemic’s fallout, this has not deterred investors’ optimism. On the bright side of the coronavirus data, confirmed infections and fatalities have dropped precipitously since vaccines began being widely distributed earlier this year, and between those having been infected or vaccinated, we are gradually moving toward herd immunity here in the U.S.

Source: JP Morgan, Economic and Market Update

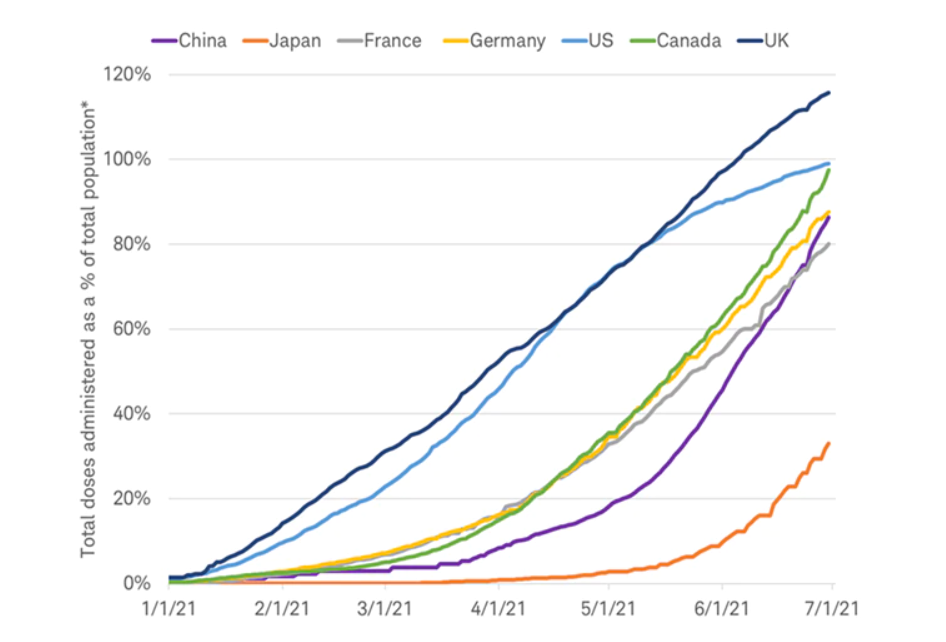

Across the developed world outside the U.S., vaccination rates continue to improve as well, as shown in the exhibit below.

Source: Charles Schwab, Bloomberg data as of 7/8/2021

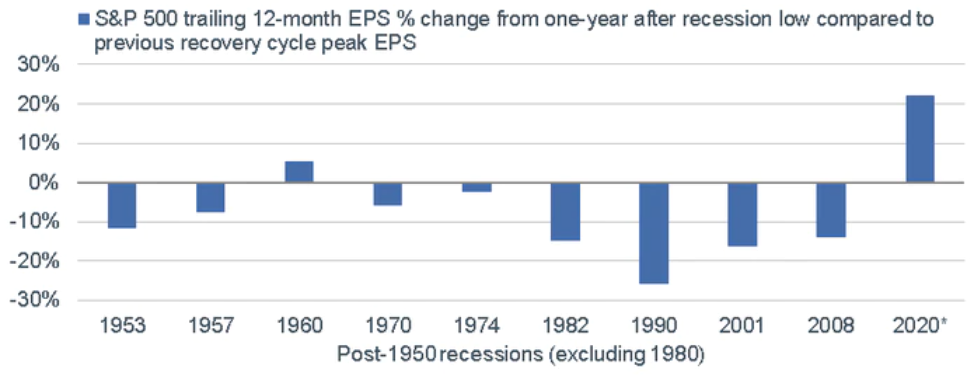

As people began to dip their toes back into society and returned to dining out and shopping once again, optimism grew for the economy’s rebound, causing upward movement of stock prices globally. In the U.S., the level of margin debt (individuals borrowing against their investment holdings, usually to buy stocks) is soaring, CEO confidence is at a record high, and the Federal Reserve has made it clear that they are happy to hold interest rates at very low levels to continue stimulating the economy. This is on the back of U.S. companies experiencing dramatic year-over-year earnings growth aided by federal stimulus that has propped up consumer spending and has facilitated a robust economic recovery following the recession in 2020. In a recent study by The Leuthold Group, it was determined that 2021 is expected to have the best profit recovery year for companies in the S&P 500 following a recession going back to World War II. The data in the chart below measured aggregate earnings per share (EPS) one year following a recession and compared it to the prior expansion’s peak. In essence, expected profits for companies in 2021 are expected to be over 20% higher than the peak of company earnings before the COVID-19 recession! We are hopeful that this will translate into continued improvement on Main Street as Wall Street reaps the rewards.

Source: Charles Schwab, Bloomberg, The Leuthold Group. *Based on median Bloomberg estimate of $185 EPS for 2021. Past performance is no guarantee of future results.

Inflation has finally arrived (and is here to stay?)

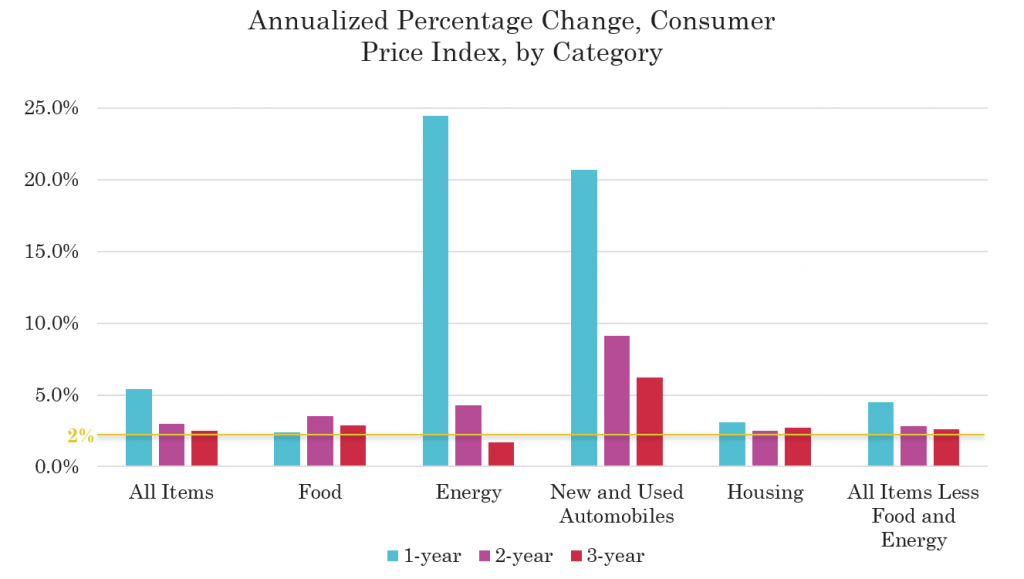

During the 2020 – 2021 recovery, inflation has ramped up significantly as the federal government provided grants, forgivable loans to small businesses, and stimulus checks and increased unemployment benefits to individual taxpayers. At the end of June, the year-over-year Consumer Price Index (CPI), which is a measurement of inflation, rose 5.4%, driven heavily by energy and automobile prices.

Source: U.S. Bureau of Labor Statistics, Consumer Price Index, June Values

It is notable that this increase in prices is measured across an abnormal time period in which our economy experienced a rapid recession and subsequent recovery, so we feel higher inflation was somewhat expected by market observers. However, due to a confluence of factors, including additional fiscal stimulus coming down the pike, a strong, de-levered U.S. consumer, lingering supply chain constraints due to COVID-19, and companies needing to pay more to find workers, we think that higher inflation could be here to stay. Historically, inflation above the Federal Reserve’s target rate (currently 2%) has caused the Fed to consider raising market interest rates in order to “cool off” an over-heated economy. However, Fed Chair Jerome Powell continues to signal to the market a willingness to keep interest rates low until it is clear that higher inflation is not simply a transitory event.As these issues are out of our control, we like to highlight how our diversified, value style of investing could be positioned to do quite well if the U.S. experiences sustained higher inflation:

- U.S. inflation could cause the dollar to de-value against other countries’ currencies. If this occurs, we believe your international stock exposure will benefit.

- Value stocks tend to reside in sectors that hold up better in an inflationary environment. These include commodity-related companies, housing developers, financials and industrials.

- In recent discussions with our mutual fund managers, many of them report that the companies owned in their portfolios have the pricing power to pass through higher costs to customers.

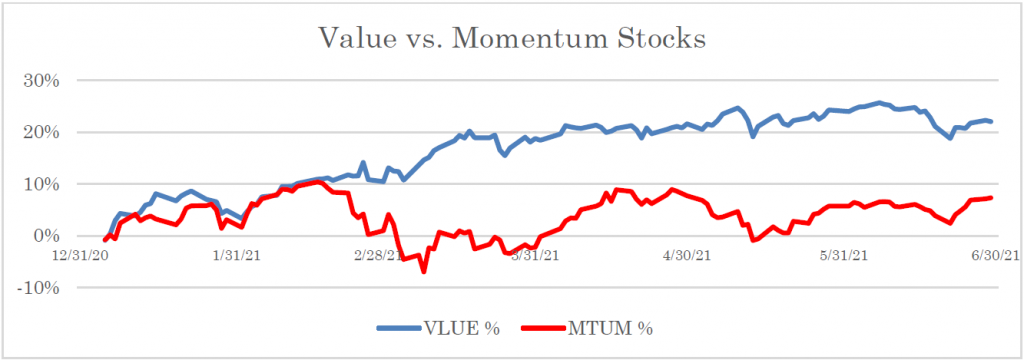

We continue to be pleased with the performance of our investment lineup and think it is positioned to do well in the changing environment. Our managers remain committed to their process of owning high-quality companies with strong balance sheets that tend to be less reliant on debt. In the first half of 2021, there has been a strong indication of value investing returning to favor, in contrast with the growth-led decade of the 2010’s. In the graph below, we have updated data shown in prior letters regarding performance of value stocks vs. momentum-driven companies in the first six months of this year.

Source: Yahoo! Finance

While we are experiencing validation of our style of investing, our opinion remains that speculative excesses still exist in some areas of the stock market, and experienced and novice investors alike are being tempted to jump in to avoid missing out. We remain disciplined in our approach, diversifying your portfolio globally and partnering with managers who attempt to avoid over-paying for a company owned in their mutual fund.

Who Can We Help?

For more than 27 years, we have helped guide individuals and families to their financial goals. As a result, our business now comes to us primarily through referrals. If you know a friend, colleague, or family member who could benefit from one of our many services, we hope you will invite them to visit our website at www.KuhnAdvisors.com to learn more about us and schedule a complimentary consultation. Our services:

-

-

- Retirement Readiness

- Investment Allocation

- Paying for College

- Social Security Planning

- Retirement Community Consultations

- Philanthropic and Family Legacy Planning

-

Please remember to contact us if there are any changes in your personal financial situation or investment objectives so that we may review your long-term investment strategy. As always, we welcome your phone calls and emails should you have any questions or would like any further information. We appreciate the opportunity to serve you and are grateful for the trust you place in us as stewards of your financial resources. Very truly yours,

Mark A. Kuhn

Scott W. Ranby

Carter L. Ellis