HIGHLIGHTS

• Office COVID-19 Status Update

• Market Update: Stocks Edge Higher Despite Virus and Fed Worries

• 2022 Investment Outlook

Office COVID-19 Status Update

Due to rising COVID-19 infection rates, we will hold client meetings via Zoom or phone calls for the foreseeable future. Our staff continues to work in-person at our office and thus is available if you need to drop off or retrieve paperwork, provided you are vaccinated and masked. All of us are fully vaccinated and boosted.

Market Update: Stocks Edge Higher Despite Virus and Fed Worries

The quarter ended December 31st saw most stock categories advancing higher, led by U.S. large stocks. Emerging markets continued to struggle, as seen in the table below.

| Asset Class | Index | Q4 Return | 2021 Return |

| U.S. Large Stocks | S&P 500 | +11.0% | +28.7% |

| U.S. Small Stocks | Russell 2000 | +2.1% | +14.8% |

| International Developed Stocks | MSCI EAFE | +2.7% | +11.3% |

| Emerging Markets | MSCI Emerging Markets | -1.3% | -2.5% |

| Bonds | Barclays Aggregate Bond | +0.0% | -1.5% |

During the fourth quarter, investors were rattled by the emergent omicron variant that quickly spread globally and fueled uncertainty about the efficacy of vaccines and the pace of society’s return to “normal.” Meanwhile, November’s 6.8% inflation reading reinforced fears that inflation would persist longer than expected, sparking investor concern that the Federal Reserve will be forced to move sooner and more aggressively to curtail the stimulus it has been providing to the economy since March 2020.

Despite these new virus and monetary policy worries, global financial markets overall posted robust returns for 2021 as economic and social activity rebounded on the back of the vaccine rollout and continued federal stimulus measures. The notable exception to the year’s positive results were emerging market stocks and U.S. bonds. The former struggled as the virus’s impact on economic activity was more pronounced in developing economies, and anxiety emerged over a host of new regulations in the Chinese economy that some feared would dampen the profit potential of technology industry leaders. Bonds, meanwhile, experienced modest declines as fixed income investors recognized the increasing probability that more persistent inflation would lead the Federal Reserve to hike interest rates soon, thus causing existing bonds, which pay lower interest rates, to become less valuable.

2022 Investment Outlook

As we enter a new year, we would like to comment on several themes that we expect to influence financial markets in 2022.

COVID-19 Pandemic

We are humble enough to know the futility of making predictions around the pandemic’s next phase. However, any indication that new variants will impact economic growth or corporate profits will likely trigger higher volatility within financial markets.

Inflation and Rising Interest Rates

After years of worrying whether the U.S. would experience deflation and negative interest rates like in other developed economies, investors are now perseverating over the exact opposite scenario: unsustainably higher prices, better known as inflation. Along with COVID-19, the “I” word has been the most frequently cited term in the various 2022 investment forecasts published by Wall Street firms.

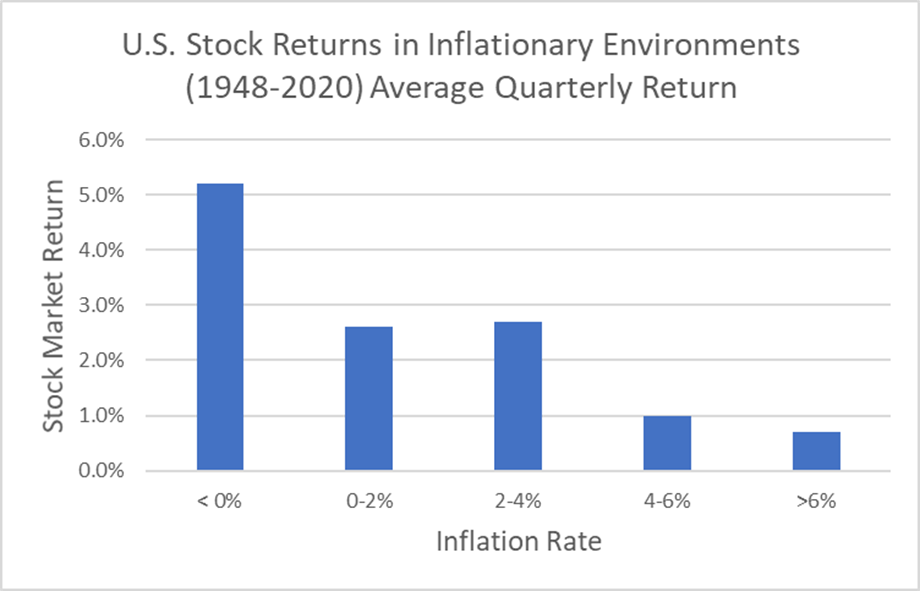

Despite the alarmist reaction of stock investors to higher inflation, history shows that, in general, equities tend to post positive returns even when inflation has trended above its long-term average of 3%. As seen in the following chart, even during periods of 4% to 6% inflation, stocks managed to eke out a gain of nearly 1% a quarter, or 4% annually.

Returns measured by S&P 500 Index. Source: Alliance Bernstein, “Stocks Can Surmount a Return of Inflation”

Investors’ apprehension of higher inflation is intertwined with the fear that persistently high readings will force the Federal Reserve to raise interest rates to levels that risk choking off economic growth.

We would like to point out the following about higher inflation and rising interest rates:

- Not all stocks will be equally impacted. Those companies with the ability to pass along higher wage and materials costs to their customers, in the form of higher prices, will be less impacted by rising input prices.

- Rates will remain historically low. Both investors and Federal Reserve members seem to agree that short-term interest rates will rise to around 1% by the end of 2022. Fed projections indicate further increases will be needed in subsequent years to get to a 2.5% rate over the longer term. We think 2.5% is hardly ruinous given that, before the 2008 financial crisis, it was possible to earn 5% on a bank CD.

- Bonds continue to play a role in portfolios. Bonds may experience modest declines in the short-term, but they still offer a strong insurance policy against major stock market declines. Plus, as interest rates move higher, investors should expect higher yields on their cash and bonds going forward.

Stock Market Leadership Rotation

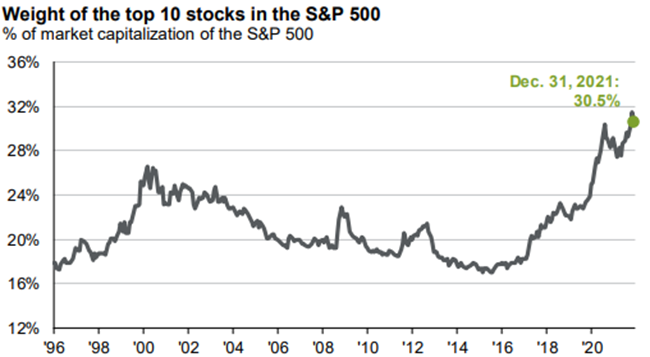

We have commented frequently that a majority of the U.S. stock market’s gains over the past five years have been due to only a handful of stocks. This trend continued during the pandemic as technology and other “stay at home” stocks rocketed to new highs, further exacerbating the concentration of these stocks in the S&P 500 index. As the chart below shows, the top ten stocks in the index now account for nearly 30% of its value, which means many investors are making a big bet that 2% of the names in the index will continue to drive it higher.

Source: JPMorgan Guide to the Markets Q12022

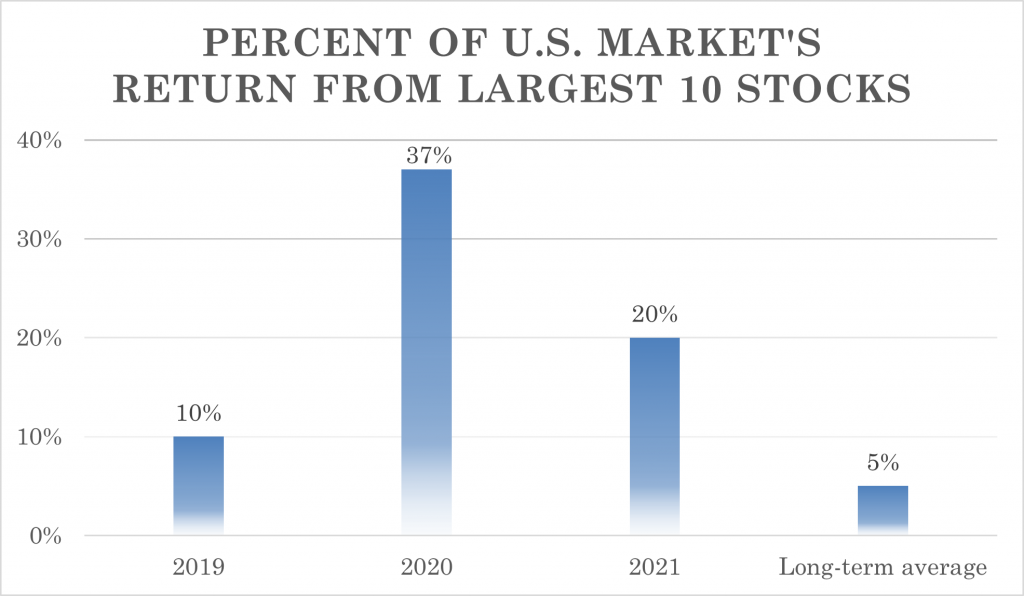

In our experience, mean reversion is a powerful force in financial markets. If a data point or trend is currently significantly above or below its long-term average, then chances are better than not that the trend will revert in the opposite direction back to the historical average. We may very well see this phenomenon play out in the U.S. stock market’s returns over the next few years, as the gains delivered by the top ten stocks over the past three years have been well above the long-term average, as evident in the following graphic.

Source: Morningstar. “The FAANG Market Is Fading”

The catalyst for this rotation in market leadership away from a handful of technology stocks to a broader range of firms may already be underway with expectations of higher interest rates. As interest rates rise, the value of future corporate profits becomes diminished. This makes shares in firms whose profits are low now, but expected to grow in the future, look more expensive relative to those firms that generate strong profits today. The changing interest rate environment will lead to repricing of such stocks.

Emerging Markets Rebound?

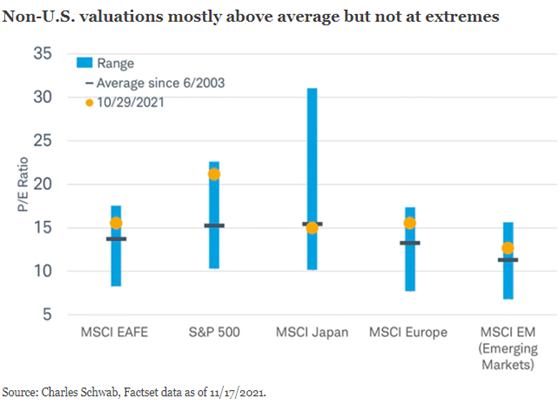

Emerging market (EM) stocks delivered extremely disappointing returns in 2021, owing to ongoing pandemic concerns, supply chain bottlenecks, as well as being overshadowed by the USA’s great economic rebound story. Hence, the opportunity for mean reversion appears to us to be especially strong as many of these 2021 headwinds become 2022 tailwinds as vaccines become more widely available, supply chain disruptions ease, and the domestic growth rate slows. A final piece of the puzzle is provided by the lower valuations that EM equities trade at compared with U.S. equities. As the following chart shows, last fall EM stocks traded slightly above their long-term price to earnings (P/E) ratio, while U.S. stocks were near the top of their nearly 20-year average.

When looking at P/E ratios across various global market segments, we are reminded of a timeless quote from the notable investor Jeremy Grantham:

“The one reality that you can never change is that a higher-priced asset will produce a lower return than a lower-priced asset. You can’t have your cake and eat it. You can enjoy it now, or you can enjoy it steadily in the distant future, but not both – and the price we pay for having this market go higher and higher is a lower 10-year return from the peak.”

– Jeremy Grantham, CNBC, Nov. 12, 2020

Our take – We expect our fund managers to continue owning companies with low debt, strong financial stability, positive cashflow, and that trade at reasonable prices relative to these characteristics. We think this is a winning combination for long-term investors.

Who Can We Help?

For more than 28 years, we have helped guide individuals and families to their financial goals. As a result, our business now comes to us primarily through referrals. If you know a friend, colleague, or family member who could benefit from one of our many services, we hope you’ll invite them to visit our website to learn more about us and schedule a complimentary consultation.

Our services:

• Retirement Readiness

• Investment Allocation

• Paying for College

• Social Security Planning

• Retirement Community Consultations

• Philanthropic and Family Legacy Planning

Please remember to contact us if there are any changes in your personal financial situation or investment objectives so that we may review your long-term investment strategy. As always, we welcome your phone calls and emails should you have any questions or would like any further information.

We appreciate the opportunity to serve you and are grateful for the trust you place in us as stewards of your financial resources.

Very truly yours,

Mark A. Kuhn & Scott W. Ranby