Highlights

- Market Update: Last Year’s Laggards are this Year’s Leaders

- Diversification for the Win!

- Where to Park Your Cash Now

- 2023 Forecast Redux- Get Ready to be Uncomfortable

- Behavioral Finance: Acting Like an Investor

Market Update: Last Year’s Laggards are this Year’s Leaders

The major benchmarks posted a second straight quarter of positive returns, as investors sensed that the Federal Reserve’s interest rate hikes are nearing an end. Encouragingly, some of our funds that had subpar results last year were among the best performers in our portfolios to start this year. This includes those that many of you have asked us about in recent meetings: Roumell, Evermore, and Artisan Emerging Markets. Conversely, our more value-oriented managers, whose funds held up relatively better in last year’s down market, lagged the broader indexes as risk taking returned to the market: Queens Road, Smead, and Dean.

Below are returns for the major asset classes for the quarter and twelve months ended March 31st, 2023.

| Asset Class | Index | Q1 Return | Last 12 Months |

| U.S. Large Stocks | S&P 500 | +7.5% | -8.0% |

| U.S. Small Stocks | Russell 2000 | +2.7% | -12.5% |

| International Developed Stocks | MSCI EAFE | +8.6% | -0.4% |

| Emerging Markets | MSCI Emerging Markets | +4.0% | -10.6% |

| Bonds | Barclays Aggregate Bond | +3.0% | -4.53% |

Diversification for the Win!

At the time of this writing, international stocks have outperformed large U.S. stocks by nearly 700 basis points over the past 12 months – 100 basis points equals 1%. This result occurred during a time when overseas headlines were just as bleak, if not bleaker, than those on the domestic front, reminding us that no one can reliably foresee the catalysts or timing of changes in market leadership.

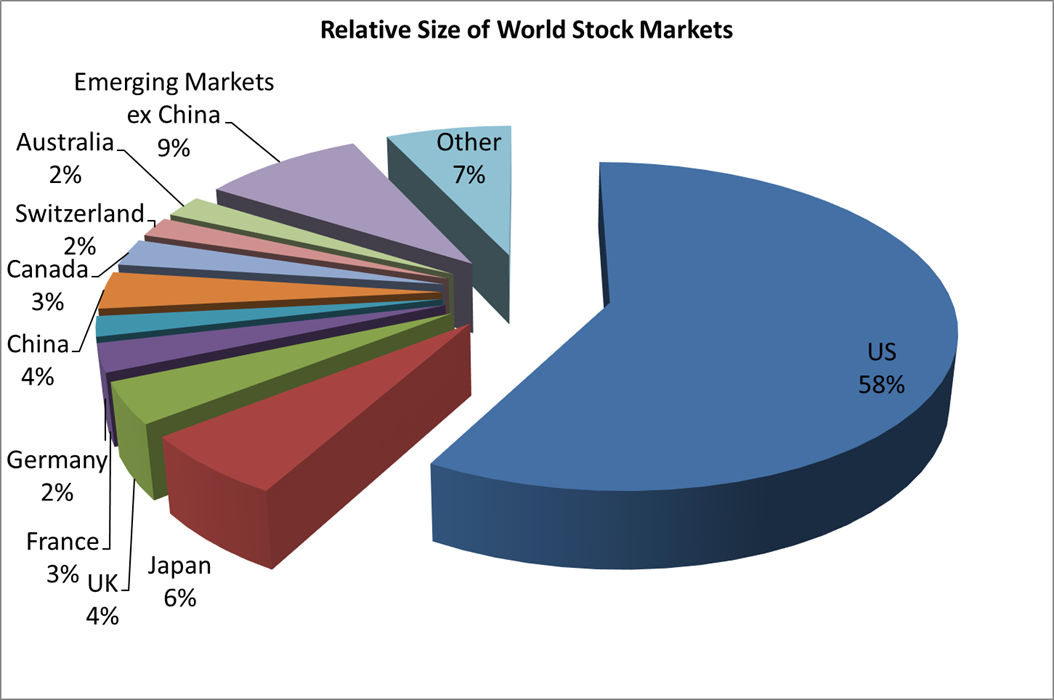

In our view, the best solution to avoid trying to predict the unpredictable is to maintain a diversified portfolio that first and foremost is designed for the time horizon of a client’s goals. We have spoken in the past about how we view bonds and cash to be the most appropriate investment vehicles for known expenses within the next one to three years. For goals beyond this period, history shows that stocks provide robust, inflation-beating returns though with inherent volatility. Within the stock portion of a portfolio, we think long-term investors should seek out opportunities among the 43,000 publicly traded companies around the world, versus confining themselves to the 4,000 such firms in the U.S. The pie chart below shows the relative value of the world’s stock markets distributed among various countries and regions.

As of January 2023 Sources: https://www.statista.com/statistics/710680/global-stock-markets-by-country/ , https://www.dimensional.com/us-en/insights/ins-and-outs-of-emerging-markets-investing

We generally recommend keeping 60% of a portfolio’s stock allocation exposed to the U.S., 20% to developed international countries such as Japan, England, and Canada, and 20% to emerging markets such as China, Brazil, and India.

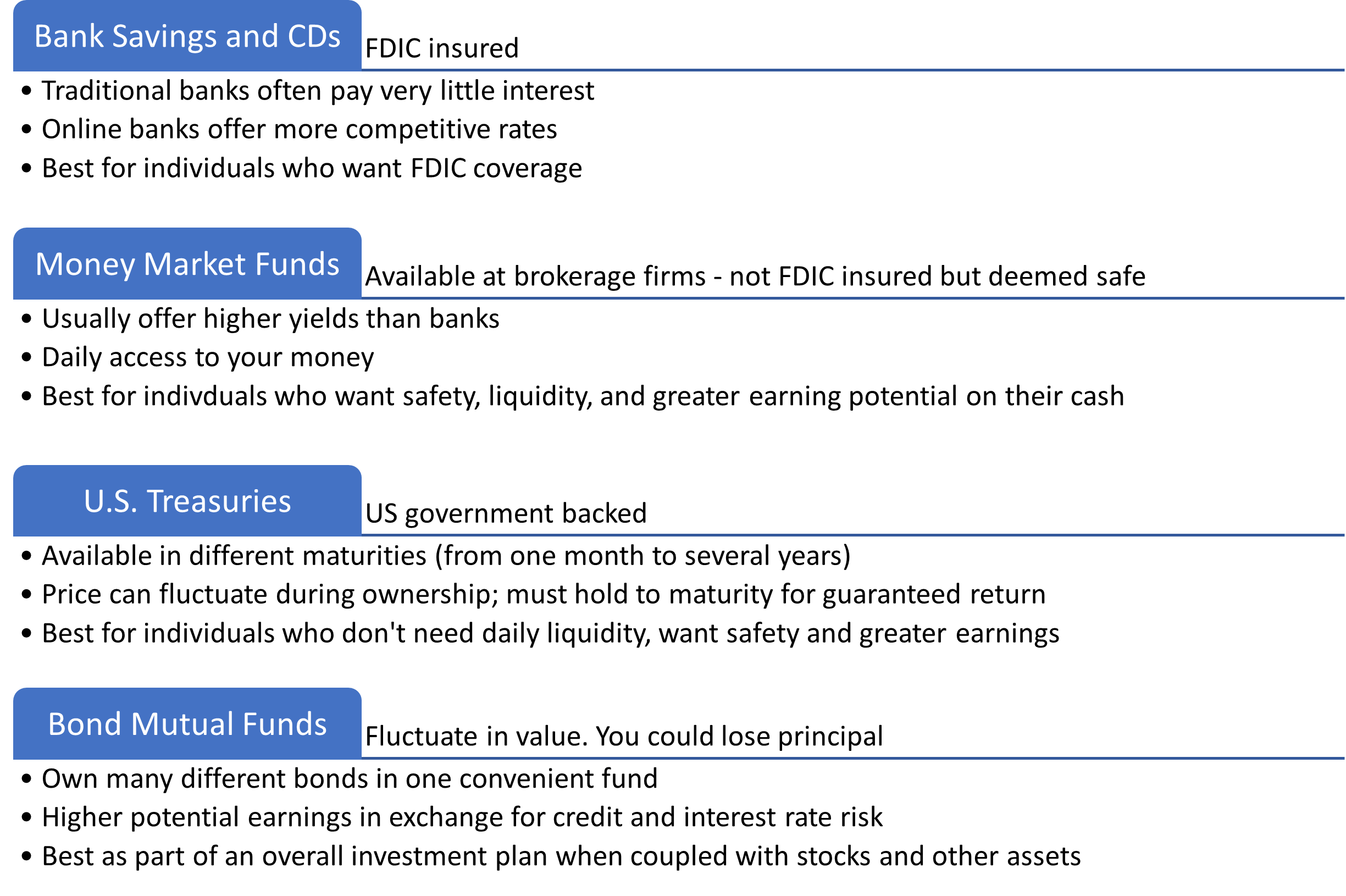

Where to Park Your Cash Now

Because the Federal Reserve raised short-term interest rates from 0% to nearly 5% over the past two years, savers with excess cash now have myriad options for earning higher returns. While these options will not keep up with inflation over the long run, they can be useful parking places for cash earmarked for near-term purposes. The chart below outlines various options to consider.

If you have questions about the suitability of any of these options for your own cash, please don’t hesitate to reach out to us for further discussion.

2023 Forecast Redux-Get Ready to be Uncomfortable

In last quarter’s commentary, we published our annual financial market and economic forecast. The first prognostication from that slightly tongue-in-cheek report bears repeating:

The economy/market will mostly likely do something that surprises us (and the experts). In hindsight, we will wonder how we didn’t see it.

Almost on cue, in early March we received our first major surprise of the year with the failures of Silicon Valley Bank and Signature Bank. As the stock market moved swiftly lower in the days these events unfolded, federal regulators were forced to hastily devise a rescue plan in hopes of preventing contagion to the rest of the financial system. For now, this seems to have appeased market participants.

Though stocks have recovered from this dip, these events serve as a stark reminder that the next crisis that causes stocks to plunge will not be something we have seen before. After all, governments and companies should now have playbooks in place to respond to risks posed by sub-prime mortgage crises and pandemics, for example. Rather, the trigger will be something novel and/or unexpected – a U.S. government default, a new geopolitical conflict, or an esoteric blowup in the bowels of the global financial system, to name a few. For example, the recent bank failures were catalyzed by a mixture of poor corporate management, an aggressive interest rate hiking cycle by the Federal Reserve, and social media, which helped fuel an old fashion bank run.

Given the improbability of correctly guessing the nature and timing of the next market shock, we suggest two ways for investors to prepare for the discomfort that will invariably accompany the next crisis. The first is to build a diversified portfolio that aligns with the timeline of your major financial goals. The second is to remember, when the crisis hits and stock prices plunge, that your stocks and mutual funds represent ownership in real companies that are meeting genuine needs of society. If you have not overpaid for that ownership and have diligently assessed the financial strength and operational durability of those firms, the chances of permanently destroying wealth are lower.

While controlling our emotions amidst material declines in one’s portfolio balance is challenging, finding financially strong companies that trade at reasonable prices to their earnings is what our fund managers aim to do daily.

Behavioral Finance: Acting Like an Investor

Many investors today unknowingly act like speculators. How do we know this? Because they are more concerned and influenced by short-term changes in stock prices than in the underlying fundamentals of a company. When volatile stock prices are coupled with a barrage of negative news stories, it can be exceedingly difficult to act like an investor.

Just this quarter we observed news about inflation, bank failures, and predictions of recessions. Most of the headlines were negative and predictably, investors withdrew over $22 billion from stock mutual funds during the first ten weeks of the new year and pumped over $97 billion into money market cash funds.[1] Despite this rush to cash, which is common among speculators (so-called “investors”), U.S. large stocks gained over 7% in the first quarter.[2]

Market participants who move to cash or bonds during an uncertain time are not investing but rather are acting on emotion and reacting to short-term market dynamics. This behavior may have a significant long-term cost in the form of missed opportunities when stocks rally. This flight to cash amounts to trading potential long-term growth for temporary relief from negative news and stock price fluctuations. It is not investing.

Investing involves owning securities for the long term with a recognition that the capital markets have always been uncertain and regularly experience significant fluctuations. Investors enter the “game” understanding that uncertainty and temporary negative returns are the price one must pay to participate in the long-term wealth generating power of capital markets.

Being an investor is not easy, but we think it is essential to achieving your long-term goals. Maintaining patience and discipline can be difficult, especially when facing uncertainty and negative outlooks, but those are the realities of capital markets. Most short-term market outcomes (price movements and news) are nothing more than noise.

As your advisors, we will help you know what information is pertinent and helpful to reach your goals, and when a course correction or change in strategy is advised.

Who Can We Help?

For 30 years, we have helped guide individuals and families toward their financial goals. As a result, our business now comes to us primarily through referrals. If you know a friend, colleague, or family member who could benefit from one of our many services, we hope you’ll invite them to visit our website at www.KuhnAdvisors.com to learn more about us and schedule a complimentary consultation.

Our services:

- Retirement Readiness

- Investment Allocation

- Paying for College

- Social Security Planning

- Retirement Community Consultations

- Philanthropic and Family Legacy Planning

Please remember to contact us if there are any changes in your personal financial situation or investment objectives so that we may review your long-term investment strategy. As always, we welcome your phone calls and e-mails should you have any questions or would like any further information.

We appreciate the opportunity to serve you and are grateful for the trust you place in us as stewards of your financial resources.

Very truly yours,

Mark A. Kuhn Scott W. Ranby

[1] Refinitiv Lipper, as reported in Barron’s, March 19, 2023

[2] S&P 500 Index Jan 1, 2023 – Mar 31, 2023