Highlights

- Office COVID-19 Status Update

- Market Update: Value Stocks Continue to Shine

- Investing vs. Speculating

- Black and White: Racial Inequality in Wealth Building

- Firm Updates: Refreshed Website and Our New CFP® Professional

Office COVID-19 Status Update

We are pleased to report that our staff should be fully vaccinated within the next month, though we will move towards a full reopening of our office at a measured pace. We are in the process of evaluating potential improvements to the office’s air ventilation system in anticipation of being able to offer in-person meetings again, likely beginning this fall. We will continue our meetings with you via Zoom or telephone for the foreseeable future. Our office is open during this time, so please call us if you need to deliver or retrieve paperwork and we can walk you through our safety protocols.

In the weeks ahead, we will send you a survey to gauge your interest and comfort level with various meeting formats (e.g. in person, telephone, video) as we navigate the environment ahead.

Market Update: Value Stocks Continue to Shine

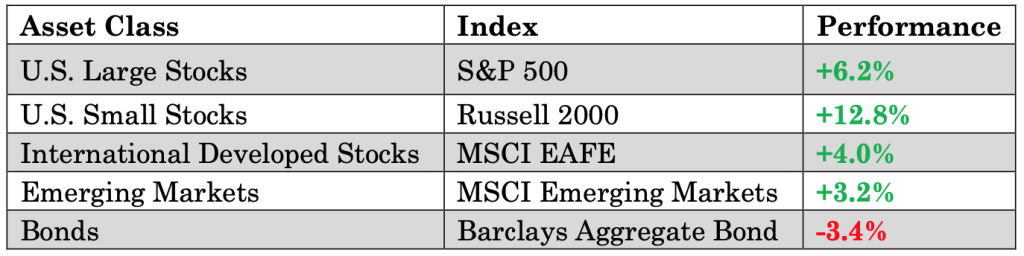

As shown in the table below, stock markets around the world continued to move higher during the first three months of 2021, fueled by mass vaccine rollouts and additional government stimulus measures. Bond markets, meanwhile, came under pressure as investors grappled with rising long-term interest rates and the prospect of future inflation.

Investors propelled equities higher during the quarter against a background of improving news on vaccine distribution, the economic recovery, and additional government support measures. In early March, President Biden signed the American Rescue Plan, a $1.9 trillion stimulus package that built upon the two previous government packages in 2020. Key provisions of the most recent plan include:

- Extending expanded unemployment and food stamp benefits until September 2021

- $1,400 direct payments to individuals with incomes below $75k ($150k for couples)

- $100 billion for vaccine distribution and expanded COVID-19 testing

- $350 billion to assist state and local governments with budget shortfalls

$130 billion to help K-12 schools open within 100 days - Expanded tax credits for low-income families

- Grants for small businesses, public transit agencies, renters, and those experiencing

homelessness

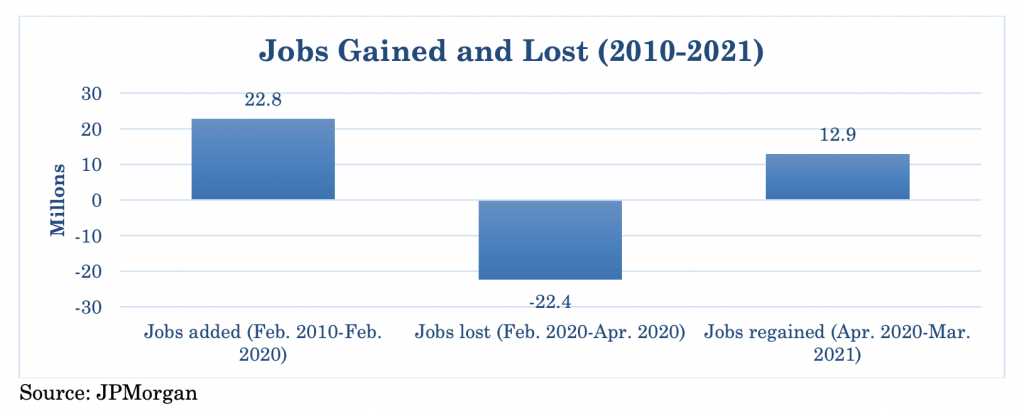

Meanwhile, significant portions of the U.S. economy are healing quite slowly from the unparalleled decline in output and jobs inflicted by the pandemic a year ago. Only about 60% of the jobs lost in the spring of 2020 have been recovered thus far.

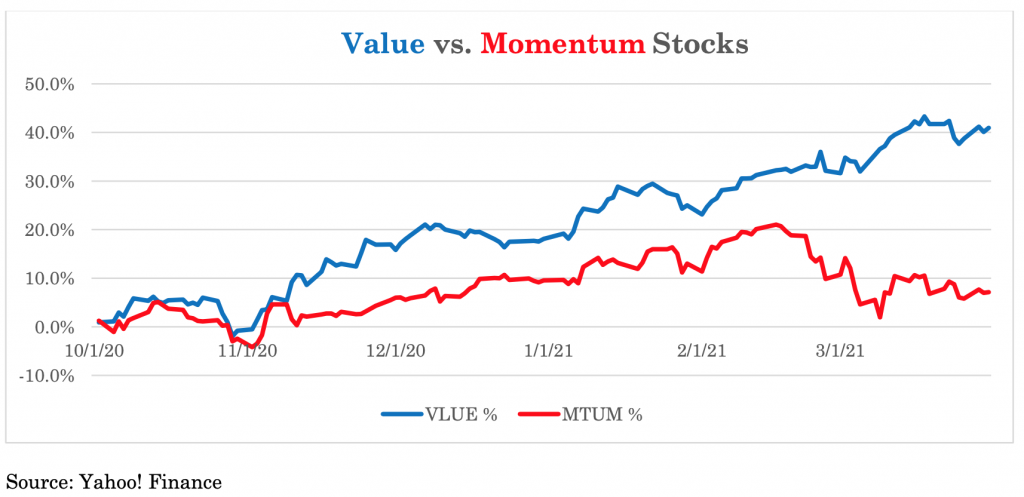

We remain very pleased with the performance of the funds within our clients’ portfolios. We believe our managers’ discipline of buying shares in low-debt, high-quality firms at attractive prices has been greatly rewarded over the past six months as investors in general gravitate toward these “value stocks” and away from the handful of popular stocks that have outpaced the broader market over the past several years. We have updated the graph below that appeared in our previous letter with market data through 3/31/21 to reinforce this observation that value stocks are outpacing their momentum brethren.

We cannot predict how long this rotation from momentum to value will last. However, the catalysts for this change in market leadership do not convey the sense of subsiding any time soon. Increased vaccination rates, massive fiscal spending, higher interest rates, inflation fears, and government scrutiny of big tech continue to influence market action.

Investing vs. Speculating

While soaring stock values are fun to watch, we have observed an uptick in speculative behavior over the past few months among everyday Americans who, flush with stimulus checks and devoid of their normal entertainment and dining outlets, have embraced the culture of Robinhood stock trading apps, cryptocurrency, financial options, leverage, and meme stocks like GameStop.

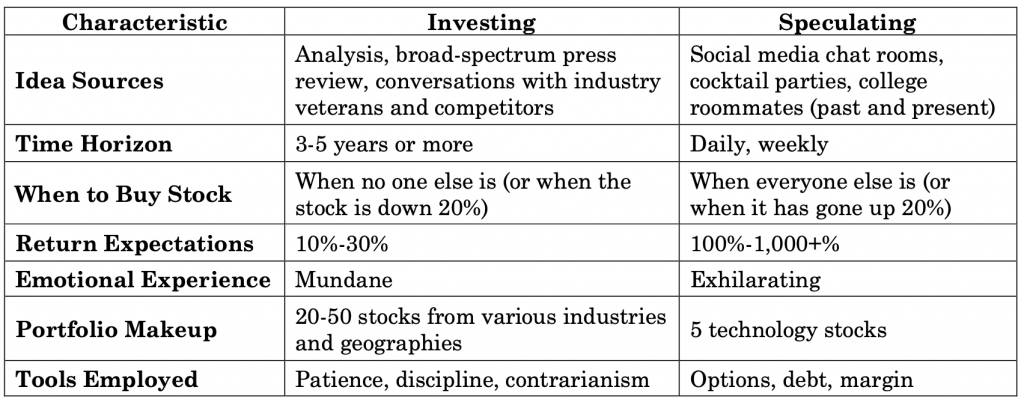

We understand the rush that comes from coming up with a “can’t miss” stock tip (“hey, everyone will be driving a Tesla in five years so the stock can only go up, right?!) and then witnessing the “investment” double or triple in value. The cold, hard truth of the matter, however, is that for every hot stock pick bragged about at a virtual cocktail party, there are ten stories of woe that go left untold. The table below details our views of the important distinctions between investing and speculating.

Most of us exhibit both types of behaviors at some point when it comes to managing our money. The key is to recognize the differences between the two and set up safeguards so that funds appropriately earmarked for investing are not put at risk through speculative behavior.

The next time you feel the urge to speculate, try remembering these strategies to help ensure a safe experience:

- Open a “mad money” brokerage account with $5,000 and day trade to your heart’s content.

- Ask if you can afford to lose all the money you wish to “invest.”

- Distract yourself from impulsive and potentially costly investment missteps – go for a walk,

read a book, or take up a new hobby. - Delete the stock market app from your phone.

- Feel confident knowing that most of your wealth is invested with Kuhn Advisors, following

what we think to be a disciplined, sound process that will put the odds of long-term success in your favor. We never “play” with your money!

Black and White: Racial Inequality in Wealth Building

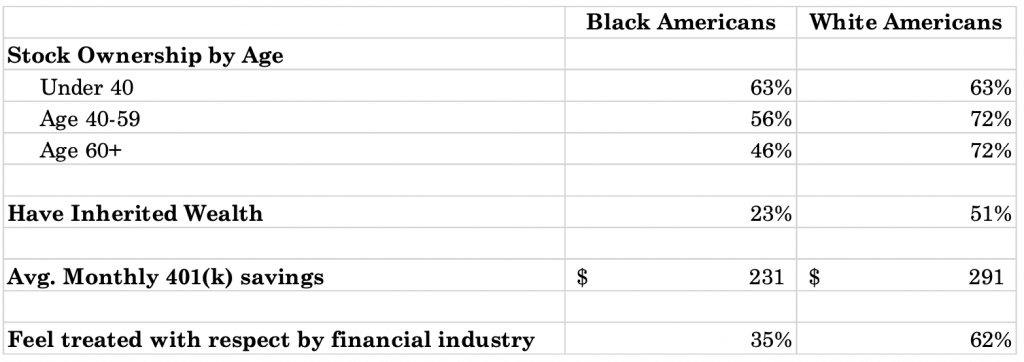

As our firm and society continue the hard work of acknowledging and rectifying the myriad racial inequities that exist in modern America, we think it is important to periodically shed light on these gaps that are relevant to our industry. The following table reveals data from the last Ariel-Schwab Black Investor Survey, now in its 20th year, and highlights compelling evidence around wealth building disparities. First and foremost, much progress needs to be made in making Black Americans feel respected by the financial services industry. We feel a good place to start would be to encourage greater diversity within the ranks of CERTIFIED FINANCIAL PLANNERTM professionals. As of 2020, only 4% of the roughly 89,000 CFP® professionals in the U.S. identify as Black or Hispanic.1

Source: Ariel/Charles Schwab https://www.aboutschwab.com/ariel-schwab-black-investor-survey-2021

One bright spot in the survey is that, as a group, Black Americans under the age of 40 exhibit higher levels of stock ownership than previous generations. We feel this is an encouraging trend given how much of our modern retirement system and aspirations for financial security are dependent on stock market wealth.

Firm Updates: Diversity Training, Refreshed Website, and Our New CFP® Professional

- Our staff recently completed a series of trainings on diversity. In the future, we hope to develop strategies to help promote careers in financial services to under-represented communities.

- Head over to www.KuhnAdvisors.com to see our refreshed website.

- Please join us in congratulating Taylor Schmaltz on completing the requirements

to be a CERTIFIED FINANCIAL PLANNERTM Professional. Taylor joined us nearly two years ago and has been a valuable addition to our team. - Retirement Readiness

- Investment Allocation

- Paying for College

- Social Security Planning

- Retirement Community Consultations

- Philanthropic and Family Legacy Planning

Who Can We Help?

For more than 27 years, we have helped guide individuals and families to their financial goals. As a result, our business now comes to us primarily through referrals. If you know a friend, colleague, or family member who could benefit from one of our many services, we hope you will invite them to visit our website at www.KuhnAdvisors.com to learn more about us and schedule a complimentary consultation.

Our services:

Please remember to contact us if there are any changes in your personal financial situation or investment objectives so that we may review your long-term investment strategy. As always, we welcome your phone calls and emails should you have any questions or would like any further information.

We appreciate the opportunity to serve you and are grateful for the trust you place in us as stewards of your financial resources.

Very truly yours,

Mark A. Kuhn

Scott W. Ranby

Carter L. Ellis